Apple, Banana and Cherry are partners in a business called Fruit Retailers. The partnership agreement provides: 1.

Question:

Apple, Banana and Cherry are partners in a business called Fruit Retailers. The partnership agreement provides:

1. Interest is to be allowed or charged on opening capital/current accounts at 15% per annum.

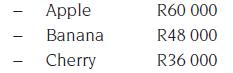

2. Partners are entitled to these annual salaries:

3. Profits are to be distributed in the ratio 2 : 2 : 1 after making good any losses brought forward from the previous financial year.

4. Losses (after allowing for interest and salaries) are to be shared by Apple and Banana in the ratio 2 : 1.

Additional information:

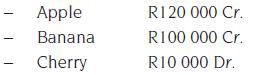

1. Capital/current account at beginning of year

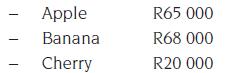

2. Drawings for the year:

3. Profit for the year R230 500 (before allowing for interest and partners’ salaries).

4. Losses from the previous financial year R30 000 (after allowing for interest and partners’ salaries).

You are required to:

Prepare the partners’ capital accounts for the current year. (Workings to be clearly shown.)

Step by Step Answer:

Fundamental Accounting

ISBN: 9781485112112

7th Edition

Authors: David Flynn, Carolina Koornhof, Ronald Arendse, Anna C. E. Coetzee, Edwardo Muriro, Louise Christel Posthumus, Louise Mancy Smit