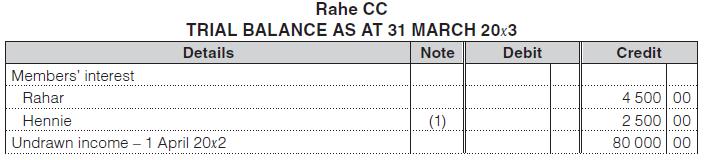

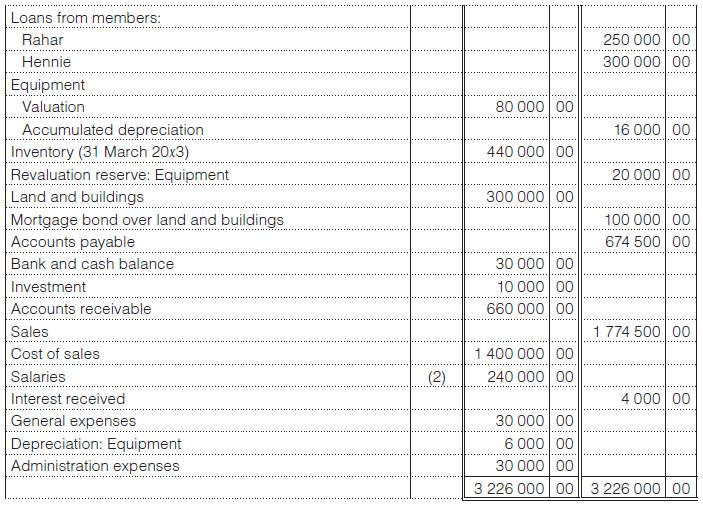

Below is the trial balance for Rahe CC (for the year ended 31 March 20x3): Additional information:

Question:

Below is the trial balance for Rahe CC (for the year ended 31 March 20x3):

Additional information:

1. Hennie contributed R2 000 at the beginning of the current year. No entry has been made. As a result, members agreed to share all profit and losses equally, including those relating to prior periods.

2. A non-refundable cash advance of R2 000 was paid to Rahar for his rent. He relocated from Durban to be a participating member of the CC. This was included in general expenses.

3. Interest of 1% per annum on loans from members has to be provided. The members agreed that this interest would be paid out at the beginning of the year ending 31 March

20x4 and should not be accrued to a loan account.

4. R10 000 of the mortgage bond is payable during the coming year ending 31 March 20x4.

5. Distribution to members for the year amounts to R120 000 (no entry has been made).

6. Income tax is at a rate of 28%.

You are required to:

1. Prepare the statement of profit or loss & other comprehensive income of Rahe CC for the year ended 31 March 20x3.

2. Prepare the members’ net investment statement for the year ended 31 March 20x3.

3. Prepare the statement of financial position of Rahe CC as at 31 March 20x3.

Step by Step Answer:

Fundamental Accounting

ISBN: 9781485112112

7th Edition

Authors: David Flynn, Carolina Koornhof, Ronald Arendse, Anna C. E. Coetzee, Edwardo Muriro, Louise Christel Posthumus, Louise Mancy Smit