Bob and Rob decided to start their own CD and tape shop and formed a CC, which

Question:

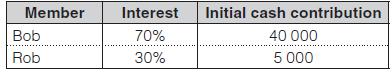

Bob and Rob decided to start their own CD and tape shop and formed a CC, which was incorporated on 1 July 20x8. They agreed to invest:

In addition:

• Bob is to contribute land and buildings valued at R50 000.

• Rob is to contribute a delivery van valued independently at R14 000.

• It was decided that land and buildings were not to be depreciated, but were to be revalued every year on 31 December.

• Vehicles are to be depreciated on a straight-line basis over five years.

This information is available for their first financial year ended 30 June 20x9:

1. On 1 August 20x8, the CC bought R15 000 worth of hi-fi and CD equipment to be used in the shop.

– To finance this purchase, Bob made a loan to the CC of R10 000.

– The balance was financed through a bank loan, repayable after three years.

– The equipment is to be depreciated on the straight-line basis over 5 years.

2. On 31 December 20x8, Bob made an additional contribution of R5 000.

3. On 31 December 20x8, the land and buildings were revalued from R50 000 to R70 000.

4. On 30 June 20x9, the CC made a loan to Rob of R1 000, repayable within 12 months.

5. Inventory is valued on the FIFO basis, and shown in the books at the lower of cost or net realisable value. Inventory at 30 June 20x9 was valued at R15 000.

6. On closing off the income and expense accounts to the profit and loss account, the net profit before tax was R32 300. The tax rate is 50%. (Ignore DWT.)

7. Distributions for the year totalled R14 000.

8. All transactions were for cash, and the closing bank balance was R52 850.

You are required to:

1. Prepare a statement of financial position for the CC on 1 July 20x8 (with a note for the members’ net investment statement).

2. Entries for the above transactions for the year (assume entries for depreciation, inventory and interest have already been posted).

3. Statement of financial position and statement of changes in equity at 30 June 20x9.

Step by Step Answer:

Fundamental Accounting

ISBN: 9781485112112

7th Edition

Authors: David Flynn, Carolina Koornhof, Ronald Arendse, Anna C. E. Coetzee, Edwardo Muriro, Louise Christel Posthumus, Louise Mancy Smit