Meg Sanderfert started a personal financial planning business when she accepted ($ 60,000) cash as advance payment

Question:

Meg Sanderfert started a personal financial planning business when she accepted \(\$ 60,000\) cash as advance payment for managing the financial assets of a large estate. Sanderfert agreed to manage the estate for a one-year period beginning April 1, 2011.

Required

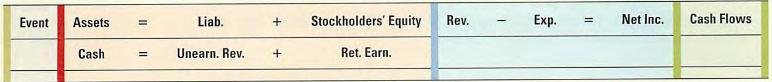

a. Show the effects of the advance payment and revenue recognition on the 2011 financial statements using a horizontal statements model like the following one. In the Cash Flows column, use OA to designate operating activity, IA for investing activity, FA for financing activity, and \(\mathrm{NC}\) for net change in cash. Use NA if the account is not affected.

b. How much revenue would Meg recognize on the 2012 income statement?

c. What is the amount of cash flow from operating activities in 2012 ?

Step by Step Answer: