Oaks Retail Stores uses the perpetual inventory system. Goods are marked up at 20% on cost and

Question:

Oaks Retail Stores uses the perpetual inventory system. Goods are marked up at 20% on cost and the VAT rate is 14%.

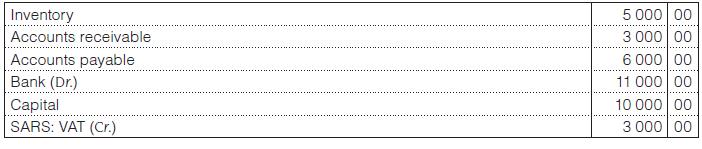

These balances appeared in the general ledger on 1 March 20x7:

Transactions for March 20x7:

1 Sold goods that cost R2 000 to B Brown Traders for cash.

2 Bought goods from B. Barusso and paid R1 710 by cheque.

3 Received R1 022 from a receivable, J. Jones, in full settlement of his account.

4 Sold goods that cost R800 to S. South Traders for cash.

8 Paid for these expenses by cheque:

11 Sold goods that cost R300 to B. Brown Traders for cash.

14 Bought office equipment for R456 and paid by cheque.

17 Bought goods for R2 337 from B & D Traders and paid by cheque.

20 A cheque for R330 was sent to a payable, A. Caruso, in full settlement of the amount.

21 Sold goods for cash and received, R2 280.

22 Paid VAT to SARS by cheque, R3 000.

27 Received R333 from D. Dowling in full settlement of her account.

31 Bought goods from Princess Wholesalers for R1 596 and paid by cheque.

You are required to:

1. Enter the transactions into the cash receipts journal and cash payments journal.

Provide for these analysis columns:

– Cash receipts journal → Sales, VAT, accounts receivable, sundry accounts, interest expense, cost of sales.

– Cash payments journal → Inventory, VAT, accounts payable, sundry accounts, interest received.

2. Post the journals to the general ledger (folio references are not required), and balance the accounts.

Step by Step Answer:

Fundamental Accounting

ISBN: 9781485112112

7th Edition

Authors: David Flynn, Carolina Koornhof, Ronald Arendse, Anna C. E. Coetzee, Edwardo Muriro, Louise Christel Posthumus, Louise Mancy Smit