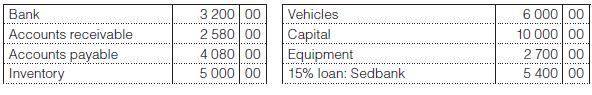

These balances appeared in the books of Swart Traders on 31 July 20x7: The lists of balances

Question:

These balances appeared in the books of Swart Traders on 31 July 20x7:

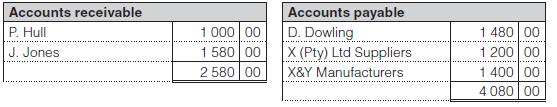

The lists of balances in the subsidiary ledgers, extracted on 31 July 20x7 were:

Transactions for August (ignore VAT):

1 Bought goods costing R3 000 from X&Y Manufacturers on credit and receiving a 2% trade discount.

Sold equipment for R1 000 to P. Hull and received a cheque for the full amount. Sold goods to J. Jones for R4 200 on credit.

2 Received R1 580 from J. Jones in full settlement of his account that was outstanding on 1 August.

4 Sold goods to P. Hull, R500 and to D. Davies, R300 on credit.

Bought goods from X (Pty) Ltd Suppliers for R600 on credit and received a trade discount of 2%. Bought stationery for R50 and paid for it by cheque.

10 Sold goods to J. Jones for R80 on credit.

Received R800 from P. Hull.

Paid D. Dowling R1 480 in full settlement of our account. Paid X (Pty) Ltd Suppliers

R1 000 on account.

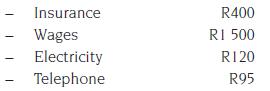

15 Paid these expenses by cheque:

20 Bought goods from D. Dowling on credit, R200.

23 Paid vehicle licences, R80.

Received a cheque from P. Hull for the full amount outstanding.

26 Sold goods to J. Brown for cash, R3 000.

31 Swart Traders depreciates its vehicles by 10% per annum.

The entry in respect of depreciation for August has not yet been recorded. Paid interest on loan for August 20x7.

Paid X&Y Manufacturers R4 000 on account. Closing inventory, R4 000.

Note

Swart Traders uses the periodic inventory system of accounting for inventory.

You are required to:

1. Enter the opening balances in the general ledger and subsidiary ledgers.

2. Record the transactions in these journals where applicable:

a. Accounts payable journal.

b. Accounts receivable journal.

c. Cash receipts journal.

d. Cash payments journal.

e. General journal.

3. Post the totals of the journals to the appropriate ledger accounts.

4. Extract the list of balances at 31 August 20x6 in the subsidiary ledgers and reconcile them to the control accounts in the general ledger.

Step by Step Answer:

Fundamental Accounting

ISBN: 9781485112112

7th Edition

Authors: David Flynn, Carolina Koornhof, Ronald Arendse, Anna C. E. Coetzee, Edwardo Muriro, Louise Christel Posthumus, Louise Mancy Smit