Tadpole Oil and Gas Company completes construction of an offshore oil platform and places it into service

Question:

Tadpole Oil and Gas Company completes construction of an offshore oil platform and places it into service on January 1, 2018. Tadpole is legally required to dismantle and remove the platform at the end of its useful life, which is estimated to be 10 years. On January 1, 2018, Tadpole recognized a liability for an asset retirement obligation and capitalized an amount for an asset retirement cost. It estimated the initial fair value of the liability using an expected present value technique. The significant assumptions used in that estimate of fair value are as follows:

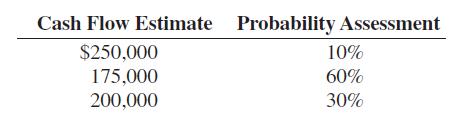

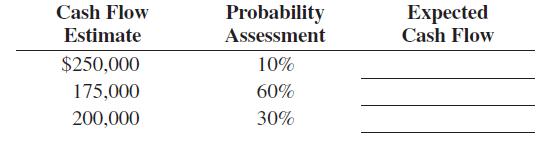

a. Labor costs are based on current marketplace wages required to hire contractors to dismantle and remove offshore oil platforms. Tadpole assigns probability assessments to a range of cash flow estimates as follows:

b. Tadpole estimates allocated overhead and equipment charges using the rate it applies to labor costs for transfer pricing (60%). The entity has no reason to believe that its overhead and equipment rate differs from that used by contractors in the industry.

c. A contractor typically adds a markup on labor, allocated internal costs, and equipment to provide a profit margin on the job. The entity determines the profit that contractors in the industry generally earn to dismantle and remove offshore oil platforms is 15%.

d. A contractor would typically demand and receive a premium (market risk premium) for bearing the uncertainty and unforeseeable circumstances inherent in “locking in” today’s price for a project that will not occur for 10 years. The entity estimates the amount of that premium to be 5% of the estimated inflation-adjusted cash flows.

e. The risk-free rate of interest on January 1, 2015 is 6%. The entity adjusts that rate by 4% to reflect the effect of its credit standing. Therefore, the credit-adjusted risk-free rate used to compute expected present value is 10%.

(Round the present value factor to four decimal places.)

f. Tadpole assumes a rate of inflation of 4% over the 10-year period. (Round the factor to four decimal places.)

REQUIRED:

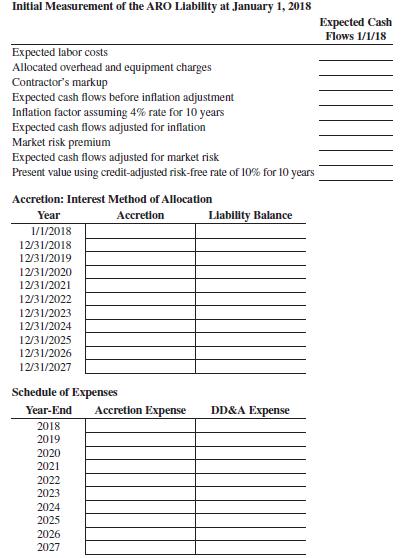

a. Complete the following tables:

b. Prepare the journal entry that would be made on January 1, 2018, to record the asset retirement obligation.

c. Prepare the journal entries that would be made from December 31, 2018, to December 31, 2027 to record the accretion expense and the amortization expense related to the ARO.

d. On December 31, 2027, the entity settles its asset retirement obligation by using its internal workforce at a cost of $432,000. Assume no changes during the 10-year period in the cash flows used to estimate the obligation. Prepare the journal entry that would be made on December 31, 2027 to record the settlement of the asset retirement obligation.

Step by Step Answer: