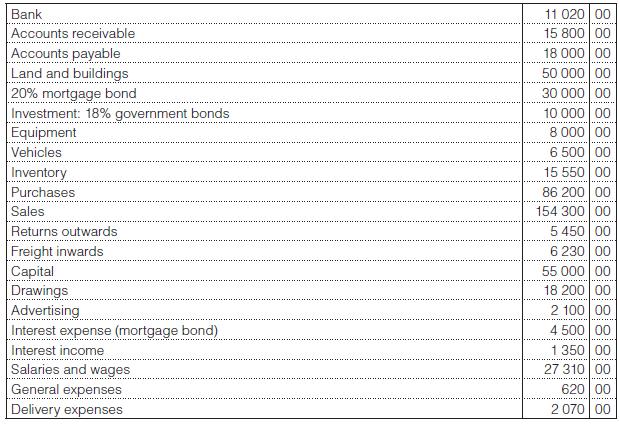

These balances and totals appeared in the books of Jack Spratt on 28 February 20x7: On presentation

Question:

These balances and totals appeared in the books of Jack Spratt on 28 February 20x7:

On presentation to management of the trial balance, it was considered essential to take these items into account:

1. The inventory on hand on 28 February 20x7 (at cost), was valued at R24 800.

2. John Davidson, whose account has a debit balance of R1 000, has been declared insolvent. Correspondence from the liquidator of his estate states that a dividend of 30c in the R1 will definitely be received.

3. An amount of R750, written off as irrecoverable in the 20x6 financial year, was received during the current year and was posted to accounts payable.

4. The mortgage bond was raised on 1 March 20x6, and interest on it is payable quarterly in arrears.

5. The business has held the investment in government bonds for the past several years.

6. Advertising includes a payment of R600 made to The Daily Bugle for advertisements for the 20x7 calendar year.

7. Equipment must be depreciated at 25% per annum and vehicles by 20% per annum both using the straight-line method.

8. Included in general expenses is an amount of R320 for airfreight on purchases made.

9. During the year, Jack Spratt took inventory that cost R1 850 for his personal use and this was not recorded.

You are required to:

1. Enter the pre-adjustment trial balance of Jack Spratt on a worksheet.

2. Prepare journal entries (where necessary) to record the additional information supplied in adjustments 1 to 9.

3. Enter your journal entries on the worksheet and complete the worksheet.

4. Draft the trading and statement of profit or loss & other comprehensive income of Jack Spratt for the year ended 28 February 20x7.

5. Prepare the statement of financial position as at 28 February 20x7.

6. Prepare the closing journal entries of John Spratt as at 28 February 20x7.

Step by Step Answer:

Fundamental Accounting

ISBN: 9781485112112

7th Edition

Authors: David Flynn, Carolina Koornhof, Ronald Arendse, Anna C. E. Coetzee, Edwardo Muriro, Louise Christel Posthumus, Louise Mancy Smit