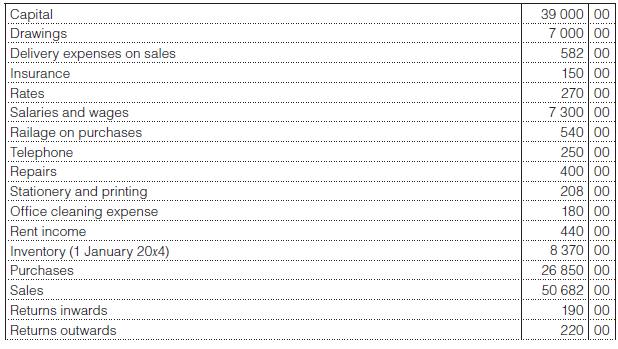

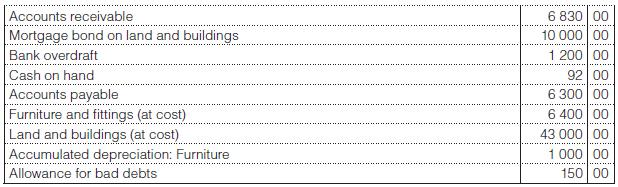

These balances were extracted from the pre-adjustment trial balance of Mark Nkosi, a general dealer, on 31

Question:

These balances were extracted from the pre-adjustment trial balance of Mark Nkosi, a general dealer, on 31 December 20x4:

Additional information:

1. Inventory on 31 December 20x4:

– Merchandise R9 560

– Stationery R54

2. Nkosi, in his own capacity, donated goods at cost to the local high school, R30.

3. Assessment rates amount to R310 per annum.

4. Salary of R150 per month is still payable to an employee for December 20x4.

5. A section of the buildings was rented from 1 January 20x4 for R40 per month.

6. On checking the receivables accounts, it is found that debts of R130 must be written off.

7. Adjust the allowance for bad debts to 5% of receivables.

8. Calculate depreciation on furniture and fittings at 10% per annum on the diminishing balance.

9. The mortgage bond started on 1 October 20x4. Interest at 18% is payable on 1 September and 1 February each year.

10. Calculate interest on capital at 16% per annum taking into consideration that Nkosi brought R2 000 new capital into the business on 1 July 20x4.

You are required to:

1. Prepare the statement of profit or loss & other comprehensive income for the financial year ended 31 December 20x4.

2. Draft the statement of financial position as at 31 December 20x4.

Step by Step Answer:

Fundamental Accounting

ISBN: 9781485112112

7th Edition

Authors: David Flynn, Carolina Koornhof, Ronald Arendse, Anna C. E. Coetzee, Edwardo Muriro, Louise Christel Posthumus, Louise Mancy Smit