This trial balance and additional information were taken from the books of Ulandi Traders as at 28

Question:

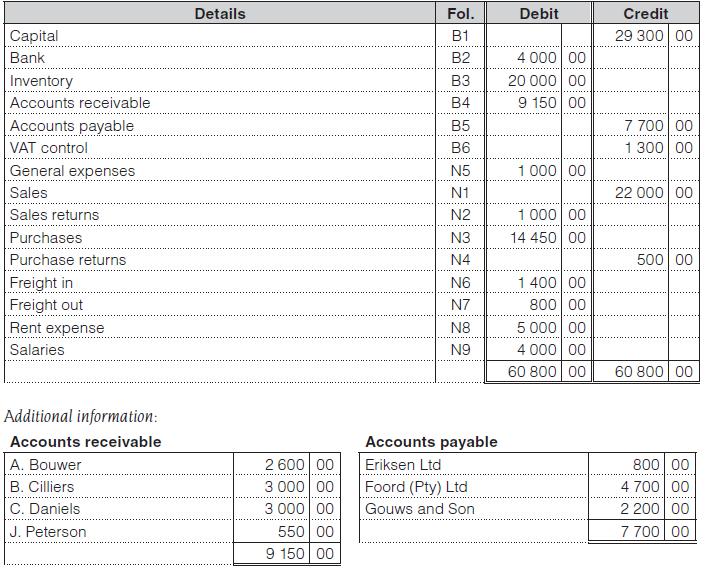

This trial balance and additional information were taken from the books of Ulandi Traders as at 28 February 20x1:

Transactions for March (assume VAT is 14%):

1 Received and deposited B. Cilliers’ cheque of R3 000 in full settlement of the account.

2 Paid rent of R684 for March to Greenside Agencies.

3 Paid Eriksen Ltd R800 in full settlement of the account.

4 Purchased goods on credit from Eriksen Ltd for R2 280.

5 Paid Spoornet R11.40 for railage on goods received from Eriksen Ltd.

8 Sold goods to B. Cilliers on credit for R3 420.

9 Paid Express Deliveries R34.20 for freight on goods delivered to B. Cilliers.

10 Accepted damaged goods returned by B. Cilliers and issued a credit note for R114.

11 Received a cheque for R34.20 from Gouws and Son for discount that had not been deducted when a payment was made to Gouws and Son on 26 February.

16 Deposited R2 000 that was received on account from Daniels.

17 Paid the amount due to Gouws and Son.

19 Paid the SARS the VAT owing for February.

20 Sold goods on credit to C. Daniels for R1 596.

24 Purchased goods on credit from Foord (Pty) Ltd for R912.

31 Paid salaries of R1 000.

You are required to:

1. Record the above transactions in the general journal.

2. Prepare a trial balance as at 31 March.

3. Prepare the accounts receivable list and the accounts payable list.

4. Prepare the VAT control account in the general ledger.

Step by Step Answer:

Fundamental Accounting

ISBN: 9781485112112

7th Edition

Authors: David Flynn, Carolina Koornhof, Ronald Arendse, Anna C. E. Coetzee, Edwardo Muriro, Louise Christel Posthumus, Louise Mancy Smit