Wildcat Gas Company owns a 33.3% working interest in a lease in West Texas. Cecil Jones, a

Question:

Wildcat Gas Company owns a 33.3% working interest in a lease in West Texas.

Cecil Jones, a local farmer, owns a 1/8 royalty interest in the lease. Wildcat is the operator, and its partners, Rocky Energy and Bush Petroleum, each own 33.3% of the working interest. Wildcat analyzed the prospects for the lease and proposed drilling a gas well. Bush agreed, but Rocky decided to go nonconsent. Wildcat and Bush both agreed to proportionately carry Rocky’s working interest. The joint operating agreement stipulates that a 150% drilling and completion cost penalty will be assessed on any partner choosing not to participate in drilling a well.

On July 1, 2020, the Gusher No. 2 was drilled and completed at a total cost of

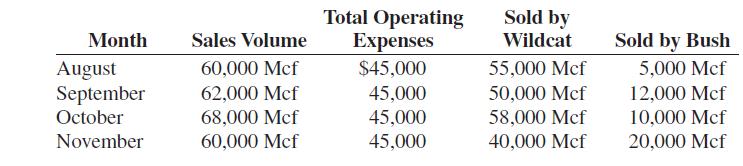

$300,000. The following information is available concerning production and sales. Assume each company contracts to sell its gas for $6.00/Mcf.

REQUIRED: Ignoring severance tax:

a. Determine when Rocky will reach payout if payout is calculated based on the quantity actually sold. Hint: Wildcat and Bush would have to compute payout separately.

b. Determine when Rocky will reach payout if payout is calculated using the amount to which each partner is entitled.

Step by Step Answer: