X, Y and Z were partners sharing profits and losses in the ratio 5 : 3 :

Question:

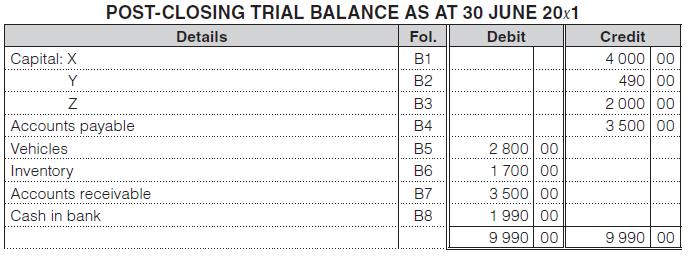

X, Y and Z were partners sharing profits and losses in the ratio 5 : 3 : 2. Their post-closing trial balance as at 30 June 20x1was: (Ignore VAT.)

On 1 July, the partners decided to dissolve the partnership and, on realising the assets, to immediately distribute cash between themselves in such a way that a partner would under no circumstances be called on to refund any cash received.

In determining the amounts to be distributed, a sum of R100 was to be kept in the bank to meet possible contingencies.

Transactions for July 20x1:

1. Accounts receivable who owed R2 000 settled their accounts in full.

2. The accounts payable were settled in full for R3 400.

3. A car was sold for R400 (which was R300 less than its carrying value).

4. Y took inventory (which had cost R600) for R1 200.

You are required to:

Show how cash should be distributed to the partners on 31 July 20x1. As the partnership agreement is silent about an insolvent partner’s deficiency, you may assume that the rule in Garner vs Murray applies in South Africa.

Step by Step Answer:

Fundamental Accounting

ISBN: 9781485112112

7th Edition

Authors: David Flynn, Carolina Koornhof, Ronald Arendse, Anna C. E. Coetzee, Edwardo Muriro, Louise Christel Posthumus, Louise Mancy Smit