Ron and Don are partners sharing profits and losses in the ratio of 3 : 2. On

Question:

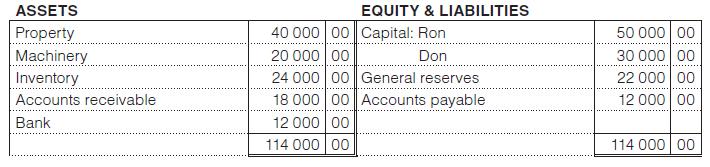

Ron and Don are partners sharing profits and losses in the ratio of 3 : 2. On 30 June 20x5, their abridged statement of financial position was: (Ignore VAT.)

On 1 July, it was agreed to admit Son into partnership. He was expected to bring in cash for R20 000, plus an additional amount for goodwill.

1. The partners decided to value goodwill at R24 000, but that goodwill was not to be shown as an asset in the statement of financial position and that no account for goodwill would be opened in the ledger. Any adjustment for goodwill, therefore, had to be made directly on capital account.

2. Property was revalued at R50 000 and inventory at R22 000. The three partners in the new partnership are to share profits and losses in this ratio: Ron = 5 : Son = 2 : Don = 1.

3. Ron and Don were to change their capital balances to be proportionate to that of Son in profit-sharing ratio. For this purpose separate loan accounts for Ron and Don were to be created.

You are required to:

1. Do the entries in the general journal to record the events described.

2. Prepare the statement of financial position of the new partnership.

Step by Step Answer:

Fundamental Accounting

ISBN: 9781485112112

7th Edition

Authors: David Flynn, Carolina Koornhof, Ronald Arendse, Anna C. E. Coetzee, Edwardo Muriro, Louise Christel Posthumus, Louise Mancy Smit