You are the newly appointed auditor of Utopia Ltd and have been presented with this statement of

Question:

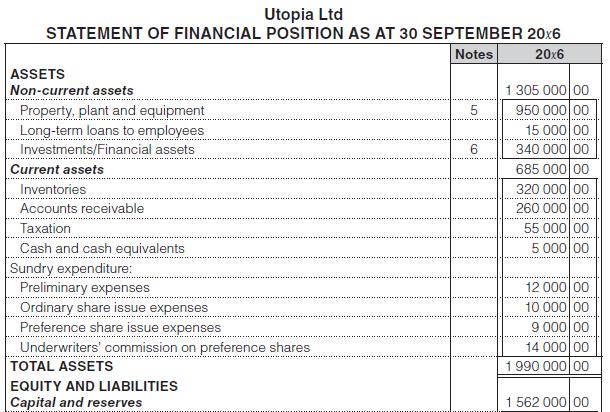

You are the newly appointed auditor of Utopia Ltd and have been presented with this statement of financial position:

Utopia Ltd

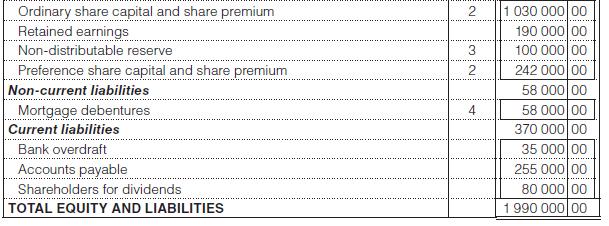

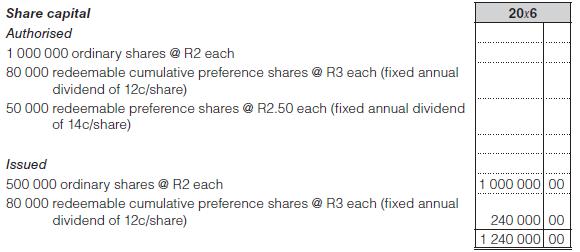

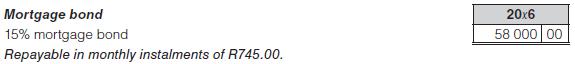

NOTES TO THE FINANCIAL STATEMENTS OF 30 SEPTEMBER 20x6

1 Accounting policies

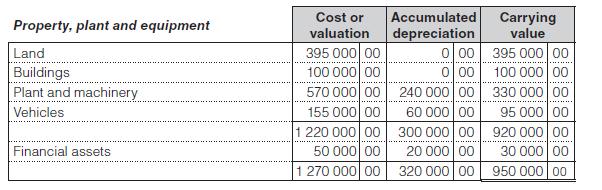

Property, plant and equipment

• Land and buildings are valued at cost and land is not depreciated. Buildings are depreciated over the useful life on the straight-line method.

• Plant and machinery and vehicles are valued at cost and are depreciated on the reducingbalance method to their residual value over the expected useful lives of the assets.

Inventory

Inventory is valued at the lower of cost and net realisable value on a FIFO basis.

2.

• The redeemable cumulative preference shares are redeemable at the option of the company from 1 December 20x6 at a premium of 30c/share.

• The directors have the authority to issue the balance of the un-issued shares until the next annual general meeting.

3.

4.

5.

6.

Additional information

This information was obtained from the minutes of various directors’ meetings:

• Utopia Ltd is presently involved in a court case with a potential claim of R250 000 against them. No provision has been made in the accounting records as the directors are of the opinion that they will win the case.

• The company contracted to acquire plant and machinery at a cost of R320 000 from Japan. The directors have authorised a further acquisition of plant of R70 000.

• At a board of directors’ meeting of Utopia Ltd, held on 3 October 20x6, it was decided:

– To redeem the 12% redeemable cumulative preference shares of the company on 30 November 20x6.

– To finance this redemption partly by the issue of the maximum number of 14% redeemable preference shares at a premium of 20%. (The company will not be able to issue these shares at a higher premium.)

– To pay the backlog in the cumulative preference dividends, last provided for on 30 September 20x4.

– To convert the authorised ordinary shares of par value into ordinary shares of no par value on 31 December 20x6.

– To write off all deferred expenditure in the accounting records immediately before the conversion of par value to no par value shares.

• Share issue expenses amounting to R5 000 have been incurred.

You are required to:

1. In point form, list all the items in the above draft statement of financial position that do not comply with the minimum disclosure requirements of the Companies Act and International Financial Reporting Standards (IFRS). (Give full details of minimum disclosure requirements.)

2. Prepare the equity and liability section of the statement of financial position as at 31 December 20x6, after the implementation of the decisions taken by the directors on 3 October 20x6.

Ignore the results of trading for the three months ended 31 December 20x6. (Show all calculations. Notes to the statement of financial position are not required.)

Step by Step Answer:

Fundamental Accounting

ISBN: 9781485112112

7th Edition

Authors: David Flynn, Carolina Koornhof, Ronald Arendse, Anna C. E. Coetzee, Edwardo Muriro, Louise Christel Posthumus, Louise Mancy Smit