Question: 1. Using the format presented in Problem 3-11B, complete the adjusted trial balance by including the adjusting entries prepared in Problem 3-11B. 2. Prepare an

1. Using the format presented in Problem 3-11B, complete the adjusted trial balance by including the adjusting entries prepared in Problem 3-11B.

2. Prepare an income statement, a statement of changes in equity, and a balance sheet based on the adjusted trial balance completed in Part 1. Assume that the owner, Ben Gibson, made an investment during the year of $20,000.

Analysis Component: Assume that total liabilities reported at June 30, 2019, were $90,000. Determine what equity and total assets were on that date and comment on the change in the financial position from 2019 to 2020.

Problem 3-11B

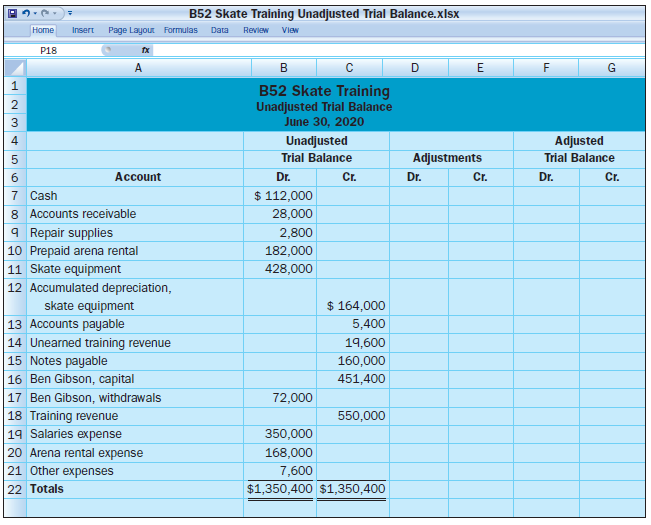

B52 Skate Training prepares adjustments annually and showed the following on its June 30, 2020, year-end:

B52 Skate Training Unadjusted Trial Balance.xlsx Home Insert Page Layour Formulas Data Review View P18 f B52 Skate Training Unadjusted Trial Balance June 30, 2020 3 Unadjusted Adjusted Trial Balance Adjustments Trial Balance Cr. $ 112,000 Cr. Dr. Account Dr. Cr. Dr. 6. 7 Cash 8 Accounts receivable 28,000 9 Repair supplies 2,800 10 Prepaid arena rental 182,000 11 Skate equipment 428,000 12 Accumulated depreciation, $ 164,000 skate equipment | 13 Accounts payable 14 Unearned training revenue 15 Notes payable |16 Ben Gibson, capital |17 Ben Gibson, withdrawals 5,400 19,600 160,000 451,400 72,000 18 Training revenue 19 Salaries expense 20 Arena rental expense 21 Other expenses 550,000 350,000 168,000 7,600 22 Totals $1,350,400 $1,350,400

Step by Step Solution

3.46 Rating (175 Votes )

There are 3 Steps involved in it

Part 1 B52 Skate Training Trial Balances June 30 2020 Account Unadjusted Trial Balance Adjustments Adjusted Trial Balance Debit Credit Debit Credit De... View full answer

Get step-by-step solutions from verified subject matter experts