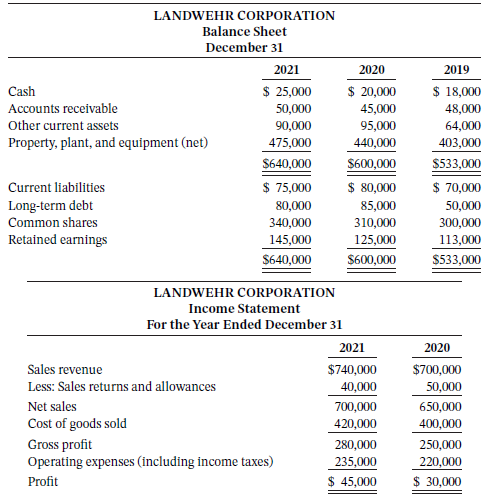

Condensed balance sheet and income statement data for Landwehr Corporation appear below: Additional information: 1. The market

Question:

Condensed balance sheet and income statement data for Landwehr Corporation appear below:

Additional information:

1. The market price of Landwehr?s common shares was $4.00, $5.00, and $8.00 for 2019, 2020, and 2021, respectively.

2. All dividends were paid in cash.

3. Weighted-average common shares were 32,000 in 2021 and 31,000 in 2020.

Instructions

a. Calculate the following ratios for 2020 and 2021.

1. Profit margin 5. Payout ratio

2. Asset turnover 6. Debt to total assets

3. Earnings per share 7. Gross profit margin

4. Price-earnings ratio

b. Based on the ratios calculated, discuss briefly the improvement or lack thereof in Landwehr Corporation?s financial position and operating results from 2020 to 2021.

Taking It Further

Roberto Landwehr is puzzled. He believes the profit margin of Landwehr is an indication the company is doing well. Julie Beck, his accountant, says that more information is needed to determine the firm?s financial well-being. Who is correct? Why?

Asset TurnoverAsset turnover is sales divided by total assets. Important for comparison over time and to other companies of the same industry. This is a standard business ratio.

Step by Step Answer:

Accounting Principles Volume 2

ISBN: 978-1119502555

8th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak