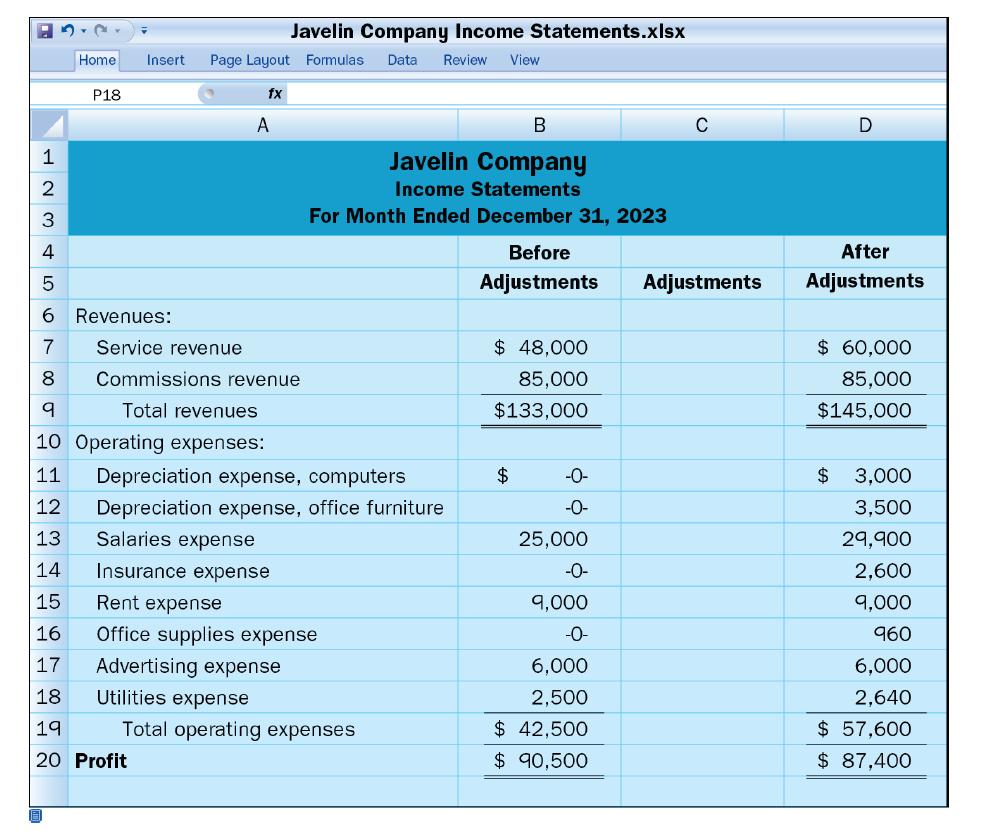

Following are two income statements for Javelin Company for the month ended December 31, 2023. Column B

Question:

Following are two income statements for Javelin Company for the month ended December 31, 2023. Column B was prepared before any adjusting entries were recorded and column D includes the effects of adjusting entries. The company records cash receipts and disbursements related to unearned and prepaid items in balance sheet accounts. Analyze the statements and prepare the adjusting entries that must have been recorded.

Analysis Component:

Identify and explain which GAAP requires that adjusting entries be recorded. By how much would revenues, expenses, and profit be overstated/understated if adjustments were not recorded at December 31, 2023, for Javelin Company?

Step by Step Answer:

Fundamental Accounting Principles Volume 1

ISBN: 9781260881325

17th Canadian Edition

Authors: Kermit D. Larson, Heidi Dieckmann, John Harris