Givens Enterprises and Runge Group are two companies that are similar in many respects. One difference is

Question:

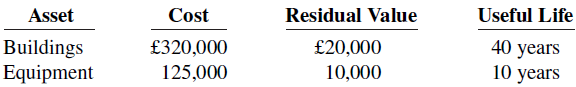

Givens Enterprises and Runge Group are two companies that are similar in many respects. One difference is that Givens uses the straight-line method, and Runge uses the declining-balance method at double the straight-line rate. On January 2, 2018, both companies acquired the following depreciable assets.

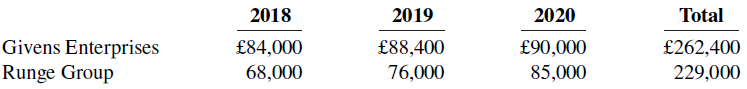

Including the appropriate depreciation charges, annual net income for the companies in the years 2018, 2019, and 2020 and total income for the 3 years were as follows.

At December 31, 2020, the statements of financial position of the two companies are similar except that Runge has more cash than Givens.

Linda Yanik is interested in buying one of the companies. She comes to you for advice.

Instructions

With the class divided into groups, answer the following.

a. Determine the annual and total depreciation recorded by each company during the 3 years.

b. Assuming that Runge also uses the straight-line method of depreciation instead of the declining balance method as in (a), prepare comparative income data for the 3 years.

c. Which company should Linda Yanik buy? Why?

Step by Step Answer:

Accounting Principles

ISBN: 978-1119419617

IFRS global edition

Authors: Paul D Kimmel, Donald E Kieso Jerry J Weygandt