Question:

It is October 16, 2020, and you have just taken over the accounting work of Saskan Enterprises, whose annual accounting period ends each October 31. The company?s previous accountant journalized its transactions through October 15 and posted all items that required posting as individual amounts, as an examination of the journals and ledgers in the Working Papers will show.

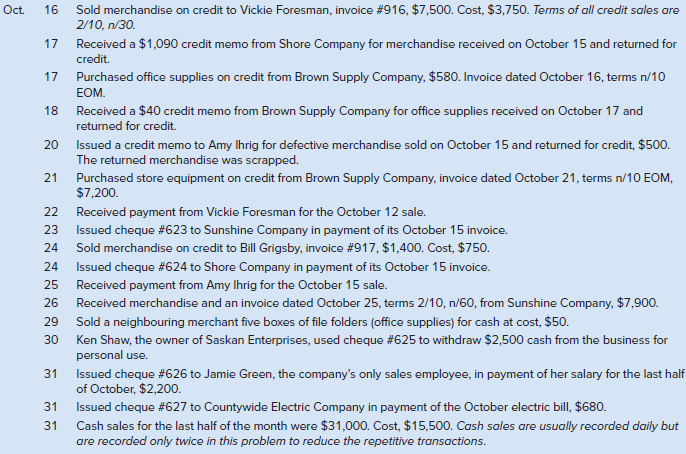

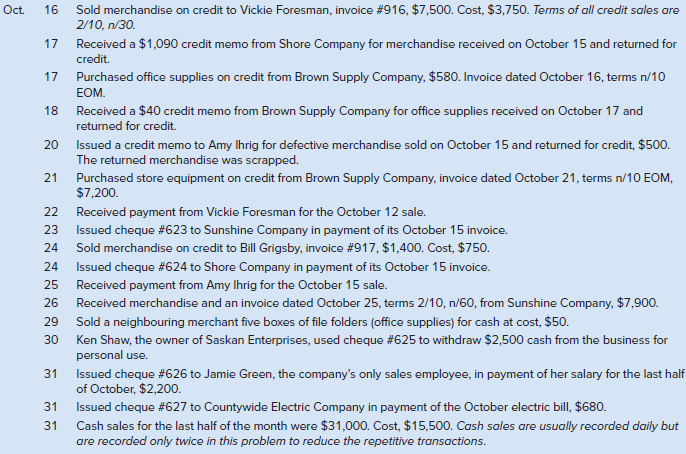

The company completed these transactions beginning on October 16, 2020:

Required

1. Record the transactions in the journals provided.

2. Post to the customer and creditor accounts and also post any amounts that should be posted as individual amounts to the general ledger accounts. (Normally, these amounts are posted daily, but they are posted only once by you in this problem because they are few in number.)

3. Foot and crossfoot the journals and make the month-end postings.

4. Prepare an October 31 trial balance and prepare schedules of accounts receivable and accounts payable.

Accounts Receivable

Accounts receivables are debts owed to your company, usually from sales on credit. Accounts receivable is business asset, the sum of the money owed to you by customers who haven’t paid.The standard procedure in business-to-business sales is that...

Transcribed Image Text:

Sold merchandise on credit to Vickie Foresman, invoice #916, $7,500. Cost, $3,750. Terms of all credit sales are 2/10, n/30. Oct. 16 Received a $1,090 credit memo from Shore Company for merchandise received on October 15 and returned for credit. 17 Purchased office supplies on credit from Brown Supply Company, $580. Invoice dated October 16, terms n/10 17 EOM. Received a $40 credit memo from Brown Supply Company for office supplies received on October 17 and 18 returned for credit. Issued a credit memo to Amy Ihrig for defective merchandise sold on October 15 and returned for credit, $500. The returned merchandise was scrapped. 20 21 Purchased store equipment on credit from Brown Supply Company, invoice dated October 21, terms n/10 EOM, $7,200. 22 Received payment from Vickie Foresman for the October 12 sale. 23 Issued cheque #623 to Sunshine Company in payment of its October 15 invoice. Sold merchandise on credit to Bill Grigsby, invoice #917, $1,400. Cost, $750. 24 24 Issued cheque #624 to Shore Company in payment of its October 15 invoice. 25 Received payment from Amy Ihrig for the October 15 sale. Received merchandise and an invoice dated October 25, terms 2/10, n/60, from Sunshine Company, $7,900. 26 Sold a neighbouring merchant five boxes of file folders (office supplies) for cash at cost, $50. Ken Shaw, the owner of Saskan Enterprises, used cheque #625 to withdraw $2,500 cash from the business for personal use. 29 30 31 Issued cheque #626 to Jamie Green, the company's only sales employee, in payment of her salary for the last half of October, $2,200. Issued cheque #627 to Countywide Electric Company in payment of the October electric bill, $680. Cash sales for the last half of the month were $31,000. Cost, $15,500. Cash sales are usually recorded daily but 31 31 are recorded only twice in this problem to reduce the repetitive transactions.