Question: A. What is Alpha One's NOPAT? Why does NOPAT differ from the earnings after taxes? B. Estimate the effective before-tax cost of the long-term

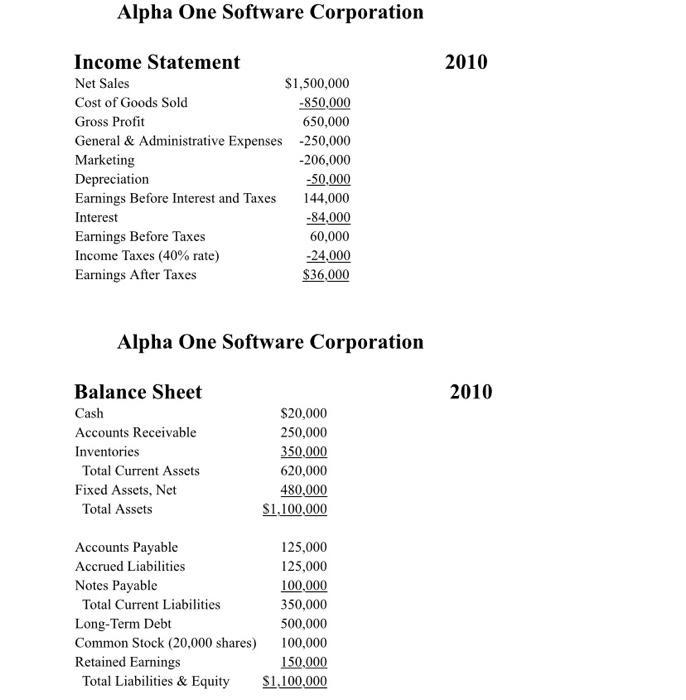

A. What is Alpha One's NOPAT? Why does NOPAT differ from the earnings after taxes? B. Estimate the effective before-tax cost of the long-term debt. c. Estimate the effective after-tax cost of the bank loan and the long-term debt. D. Estimate the cost of common equity capital. E. Determine the financial structure weights for the two interest-bearing debt components and the common equity. F. What is Alpha One's WACC? G. Determine the dollar cost of financial capital used. H. Estimate Alpha One's economic value added (EVA). Alpha One Software Corporation Income Statement Net Sales Cost of Goods Sold $1,500,000 -850,000 Gross Profit 650,000 General & Administrative Expenses -250,000 Marketing -206,000 Depreciation -50,000 Earnings Before Interest and Taxes 144,000 Interest -84,000 Earnings Before Taxes 60,000 Income Taxes (40% rate) -24,000 Earnings After Taxes $36,000 Alpha One Software Corporation Balance Sheet Cash Accounts Receivable Inventories Total Current Assets Fixed Assets, Net Total Assets Accounts Payable Accrued Liabilities Notes Payable Total Current Liabilities Long-Term Debt Common Stock (20,000 shares) Retained Earnings Total Liabilities & Equity $20,000 250,000 350,000 620,000 480,000 $1,100,000 125,000 125,000 100,000 350,000 500,000 100,000 150,000 $1,100,000 2010 2010

Step by Step Solution

There are 3 Steps involved in it

A Alpha Ones NOPAT is 144000 which is its Earnings Before Interest and Taxes EBIT NOPAT differs fro... View full answer

Get step-by-step solutions from verified subject matter experts