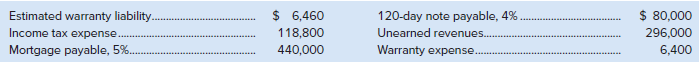

Mackenzie Corp. is preparing the December 31, 2020, year-end financial statements. Following are selected unadjusted account balances:

Question:

Mackenzie Corp. is preparing the December 31, 2020, year-end financial statements. Following are selected unadjusted account balances:

Additional information:

a. $10,800 of income tax was accrued monthly from January through to November inclusive and paid on the 15th day of the following month. The actual amount of tax expense for the year is determined to be $126,040.

b. A customer is suing the company. Legal advisers believe it is probable that the company will have to pay damages, the amount of which will approximate $140,000 given similar cases in the industry.

c. During December, Mackenzie had sales of $710,000. 5% of sales typically require warranty work equal to 20% of the sales amount.

d. Mortgage payments are made on the first day of each month.

e. $111,500 of the Unearned Revenues remain unearned at December 31, 2020.

f. The 120-day note payable was dated November 15, 2020.

Required

1. Prepare any required adjusting entries at December 31, 2020, for each of the above.

2. Determine the adjusted amounts for total liabilities and profit assuming these were $940,000 and $620,000, respectively, prior to preparing the adjustments in (a) to (f) above.

Analysis Component: What is the effect on the income statement and balance sheet if the above entries are not recorded? Identify which GAAP, if any, would be violated if these entries are not recorded.

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer:

Fundamental Accounting Principles Volume II

ISBN: 978-1260305838

16th Canadian edition

Authors: Kermit Larson, Tilly Jensen, Heidi Dieckmann