Presented below are the financial statements of Rajesh Ltd. Rajesh Ltd. Income Statement For the Year Ended

Question:

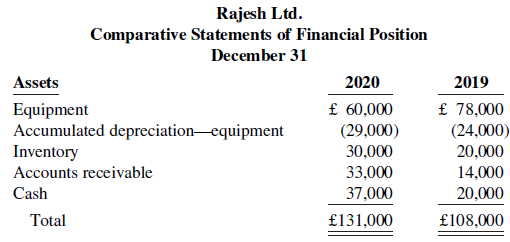

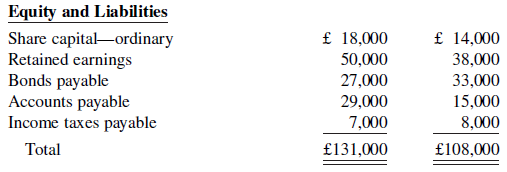

Presented below are the financial statements of Rajesh Ltd.

Rajesh Ltd.

Income Statement

For the Year Ended December 31, 2020

Sales revenue................................................£242,000

Cost of goods sold .........................................175,000

Gross profit .......................................................67,000

Operating expenses ........................................24,000

Income from operations .................................43,000

Interest expense ...............................................3,000

Income before income taxes ........................40,000

Income tax expense .........................................8,000

Net income ...................................................£ 32,000

Additional data:

1. Depreciation expense is £13,300.

2. Dividends declared and paid were £20,000.

3. During the year, equipment was sold for £9,700 cash. This equipment cost £18,000 originally and had accumulated depreciation of £8,300 at the time of sale.

Instructions

a. Prepare a statement of cash flows using the indirect method.

b. Compute free cash flow.

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Accounting Principles

ISBN: 978-1119419617

IFRS global edition

Authors: Paul D Kimmel, Donald E Kieso Jerry J Weygandt