Set up a table with the following headings for a bank reconciliation as of September 30: For

Question:

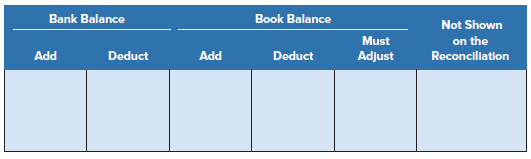

Set up a table with the following headings for a bank reconciliation as of September 30:

For each item that follows, place an X in the appropriate column to indicate whether the item should be added to or deducted from the book or bank balance, or whether it should not appear on the reconciliation. If the book balance is to be adjusted, place a Dr. or Cr. in the Must Adjust column to indicate whether the Cash balance should be debited or credited.

1. Interest income earned on the account.

2. Deposit made on September 30 after the bank was closed.

3. Cheques outstanding on August 31 that cleared the bank in September.

4. NSF cheque from customer returned on September 15 but not recorded by the company.

5. Cheques written and mailed to payees on September 30.

6. Deposit made on September 5 that was processed on September 8.

7. Bank service charge.

8. Cheques written and mailed to payees on October 5.

9. Cheques written by another company but charged against the company?s account in error.

10. Customer payment through electronic fund transfer received in the bank but not recorded in the company?s books.

11. Bank charge for collection of electronic fund transfer in Item 10.

12. Cheque written against the account and cleared by the bank; not recorded by the bookkeeper.

Step by Step Answer:

Fundamental Accounting Principles Volume I

ISBN: 978-1260305821

16th Canadian edition

Authors: Kermit Larson, Tilly Jensen, Heidi Dieckmann