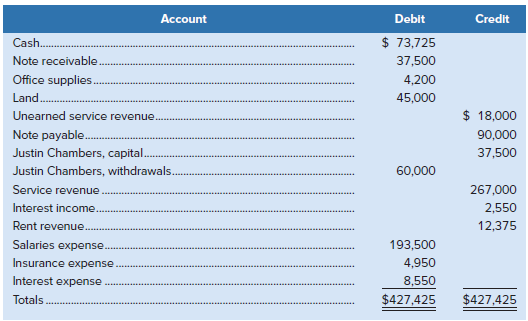

Smart Resource Company?s unadjusted trial balance on December 31, 2020, the end of its annual accounting period,

Question:

Smart Resource Company?s unadjusted trial balance on December 31, 2020, the end of its annual accounting period, is as follows:

Information necessary to prepare adjusting entries is as follows:

a. Employees, who are paid $7,500 every two weeks, have earned $5,250 since the last payment. The next payment of $7,500 will be on January 4.

b. Smart Resource has earned but not recorded revenue for $8,250 for services provided to a customer who will pay for the work on January 24. At that time, the customer will also pay $3,100 for services Smart Resource will perform in early January.

c. Smart Resource rents office space to a tenant who has paid only $450 of the $1,125 rent for December. On January 12, the tenant will pay the remainder along with the rent for January.

d. An inventory of office supplies discloses $675 of unused supplies.

e. Premiums for insurance against injuries to employees are paid monthly. The $450 premium for December will be paid January 12.

f. Smart Resource owes $90,000 on a note payable that requires quarterly payments of accrued interest. The quarterly payments of $2,700 each are made on the 15th of January, April, July, and October.

g. An analysis of Smart Resource?s service contracts with customers shows that $6,300 of the amount customers have prepaid remains unearned.

h. Smart Resource has a $37,500 note receivable on which interest of $175 has accrued. On January 22, the note and the total accrued interest of $575 will be repaid to Smart Resource.

Required

1. Prepare adjusting journal entries.

2. Prepare reversing entries.

3. Prepare journal entries to record the January 2021 cash receipts and cash payments identified in the above information.

Step by Step Answer:

Fundamental Accounting Principles Volume I

ISBN: 978-1260305821

16th Canadian edition

Authors: Kermit Larson, Tilly Jensen, Heidi Dieckmann