Question: Using the general journal entries prepared in Problem 2-4B, complete the following: 1. Set up the following accounts (use the balance column format or T-accounts):

Using the general journal entries prepared in Problem 2-4B, complete the following:

1. Set up the following accounts (use the balance column format or T-accounts): Cash (101); Accounts Receivable (106); Office Supplies (124); Prepaid Insurance (128); Prepaid Rent (131); Office Equipment (163); Accounts Payable (201); Francis Dhami, Capital (301); Francis Dhami, Withdrawals (302); Accounting Revenue (401); Professional Development Expense (680); and Utilities Expense (690).

2. Post the entries to the general ledger accounts and enter the balance after each posting.

3. Prepare a trial balance as of September 30, 2020.

Problem 2-4B

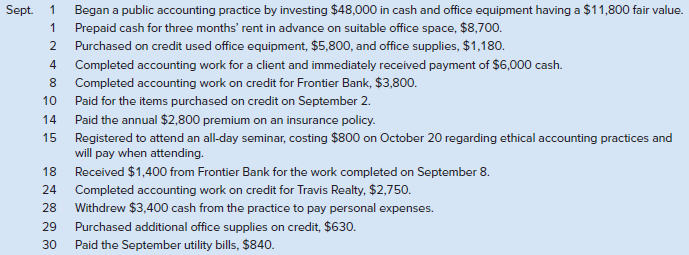

Francis Dhami, Public Accountant, completed these activities during September 2020, the first month of operations:

Began a public accounting practice by investing $48,000 in cash and office equipment having a $11,800 fair value. Prepaid cash for three months' rent in advance on suitable office space, $8,700. Sept. Purchased on credit used office equipment, $5,800, and office supplies, $1,180. Completed accounting work for a client and immediately received payment of $6,000 cash. 8 Completed accounting work on credit for Frontier Bank, $3,800. Paid for the items purchased on credit on September 2. 10 Paid the annual $2,800 premium on an insurance policy. 14 15 Registered to attend an all-day seminar, costing $800 on October 20 regarding ethical accounting practices and will pay when attending. Received $1,400 from Frontier Bank for the work completed on September 8. 18 24 Completed accounting work on credit for Travis Realty, $2,750. Withdrew $3,400 cash from the practice to pay personal expenses. 28 Purchased additional office supplies on credit, $630. 29 Paid the September utility bills, $840. 30

Step by Step Solution

3.40 Rating (172 Votes )

There are 3 Steps involved in it

Parts 1 and 2 Cash Acct No 101 Date Explanation PR Debit Credit Balance 2020 Sept 1 G1 48000 48000 1 ... View full answer

Get step-by-step solutions from verified subject matter experts