Question: 9. (17 marks) An investor has R100 and is considering investing in two different stocks. The prices of both stocks are assumed to follow the

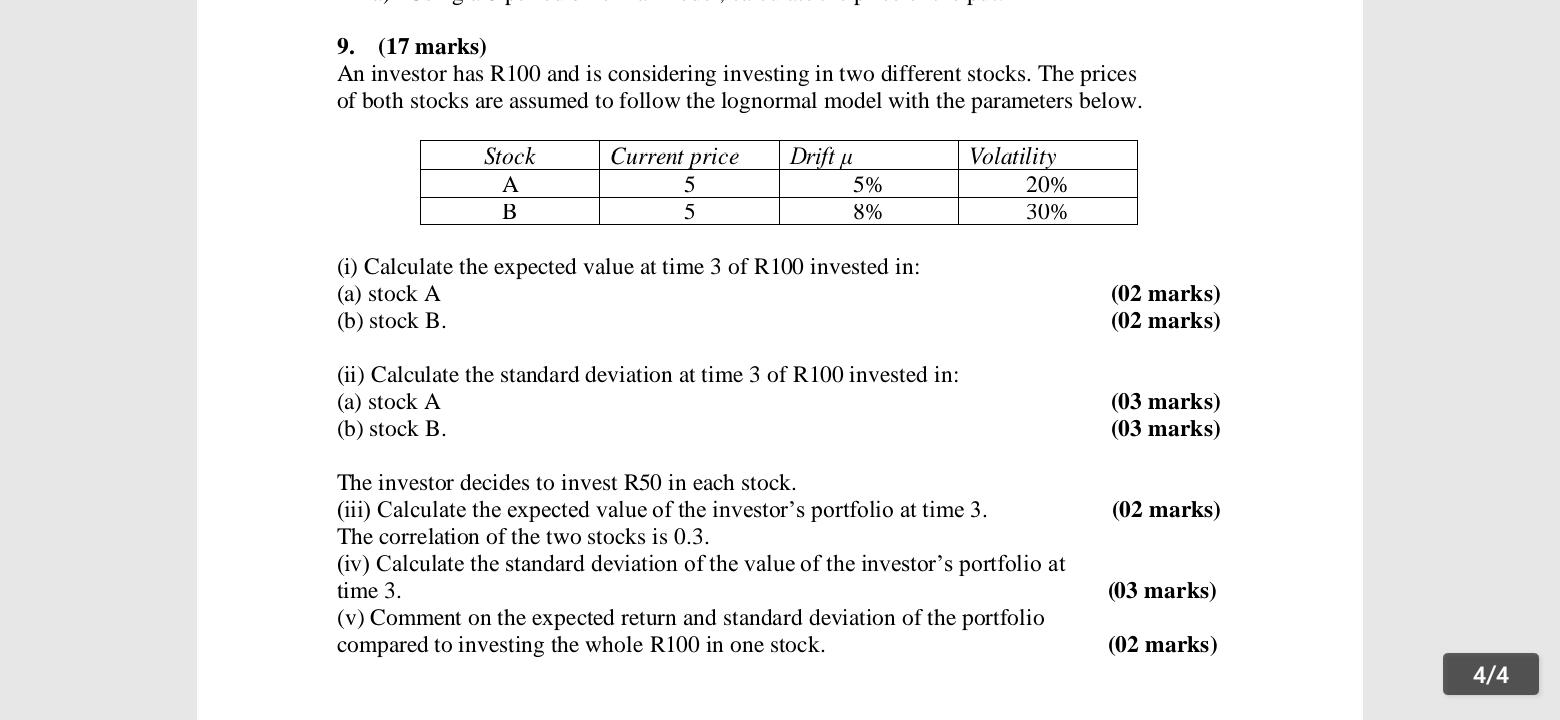

9. (17 marks) An investor has R100 and is considering investing in two different stocks. The prices of both stocks are assumed to follow the lognormal model with the parameters below. Stock A B Current price 5 5 Drift u 5% 8% Volatility 20% 30% (i) Calculate the expected value at time 3 of R100 invested in: (a) stock A (b) stock B. (02 marks) (02 marks) (ii) Calculate the standard deviation at time 3 of R100 invested in: (a) stock A (b) stock B. (03 marks) (03 marks) (02 marks) The investor decides to invest R50 in each stock. (iii) Calculate the expected value of the investor's portfolio at time 3. The correlation of the two stocks is 0.3. (iv) Calculate the standard deviation of the value of the investor's portfolio at time 3. (v) Comment on the expected return and standard deviation of the portfolio compared to investing the whole R100 in one stock. (03 marks) (02 marks) 4/4 9. (17 marks) An investor has R100 and is considering investing in two different stocks. The prices of both stocks are assumed to follow the lognormal model with the parameters below. Stock A B Current price 5 5 Drift u 5% 8% Volatility 20% 30% (i) Calculate the expected value at time 3 of R100 invested in: (a) stock A (b) stock B. (02 marks) (02 marks) (ii) Calculate the standard deviation at time 3 of R100 invested in: (a) stock A (b) stock B. (03 marks) (03 marks) (02 marks) The investor decides to invest R50 in each stock. (iii) Calculate the expected value of the investor's portfolio at time 3. The correlation of the two stocks is 0.3. (iv) Calculate the standard deviation of the value of the investor's portfolio at time 3. (v) Comment on the expected return and standard deviation of the portfolio compared to investing the whole R100 in one stock. (03 marks) (02 marks) 4/4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts