Home-style Wool Company knits clothing from merino wool and sells online and at craft fairs. Gina takes

Question:

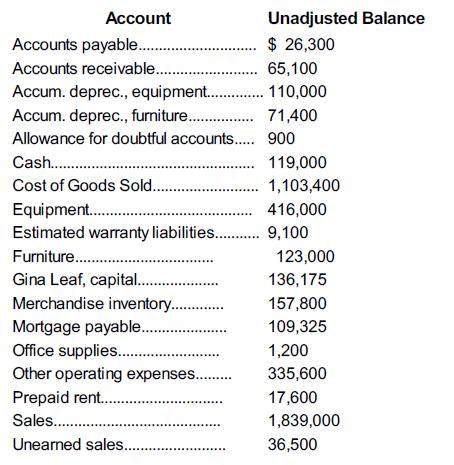

Home-style Wool Company knits clothing from merino wool and sells online and at craft fairs. Gina takes deposits for custom orders. The person preparing the adjusting entries at year-end left for a vacation prior to completing the adjustments. You have been given the following unadjusted trial balance along with some additional information for the December 31, 2023, year-end.

Other information:

1. Assume all accounts have a normal balance.

2. 30% of the balance in Unearned Sales is from sales earned during 2023; the remaining balance is for 2024 sales.

3. Home-style warranties its clothing against manufacturer defects and estimates that 4.5% of the 18,800 garments sold during 2023 will be returned for replacement. The average cost of the garments is $75.

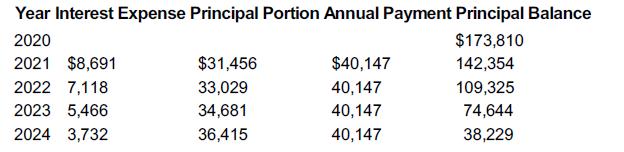

4. The mortgage payment is paid annually on January 2 each year for the interest from the previous year. The current interest expense has not been recorded. A partial amortization schedule for the mortgage payable follows:

5. 3% of outstanding receivables are estimated to be uncollectible.

6. A physical count of the inventory showed a balance actually on hand of $143,940.

7. Gina had shipped an order for $55,240 for inspection to a retailer in Whistler on December 1. On December 31 the retailer promised to pay for the goods and signed a 3% note to pay for them on March 31, 2024. The bookkeeper did not record the sale or the receivable.

Required

1. Based on the information provided, journalize the adjusting entries at December 31, 2023.

2. Prepare a classified balance sheet (round all values on the balance sheet to whole numbers).

Step by Step Answer:

Fundamental Accounting Principles Volume 2

ISBN: 9781260881332

17th Canadian Edition

Authors: Kermit D. Larson, Heidi Dieckmann, John Harris