Westfair Foods Partial Balance Sheet December 31, 2023 1 The machinery was purchased on January 1, 2018,

Question:

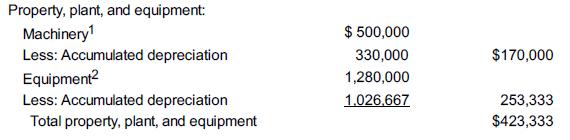

Westfair Foods Partial Balance Sheet December 31, 2023

1The machinery was purchased on January 1, 2018, and is depreciated to the nearest whole month using the straight-line method. Its total estimated useful life is eight years with a $60,000 residual value.2The equipment was purchased on August 1, 2021, and is depreciated to the nearest whole month using the double-declining-balance method. The useful life is estimated to be four years with a residual value of $36,000.

Required

1. Calculate and record depreciation for the year ended December 31, 2024, for both the machinery and equipment (round calculations to the nearest whole dollar).

2. Prepare the property, plant, and equipment section of the balance sheet at December 31, 2024.

Step by Step Answer:

Fundamental Accounting Principles Volume 2

ISBN: 9781260881332

17th Canadian Edition

Authors: Kermit D. Larson, Heidi Dieckmann, John Harris