Calculate the BlackScholes option price in each of the cases that follow. The risk-free rate and standard

Question:

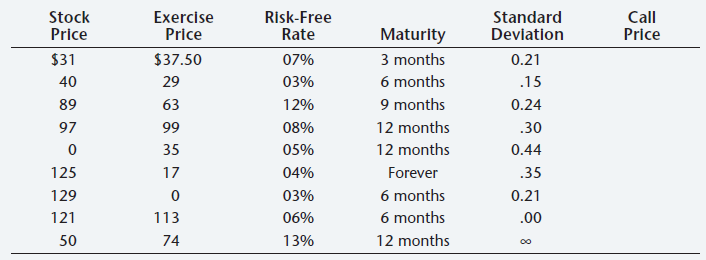

Calculate the Black–Scholes option price in each of the cases that follow. The risk-free rate and standard deviation are quoted in annual terms. The last three cases may require some thought.

Round computed values for d1 and d2 to the nearest values in Table 25A.1 for determining N(d1) and N(d2), respectively.

Transcribed Image Text:

Exercise Standard Call Stock Risk-Free Rate Price Price Maturity 3 months 6 months 9 months 12 months 12 months Forever 6 months 6 months 12 months Deviation 0.21 .15 0.24 .30 Price $31 40 89 97 $37.50 29 63 07% 03% 12% 99 08% 35 05% 0.44 125 129 121 50 .35 17 04% 0.21 03% 113 06% .00 74 13% 00

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 71% (7 reviews)

Accurate values for the standard normal distribution are used here based on Excels NO...View the full answer

Answered By

Collins Omondi

I have been an academic and content writer for at least 6 years, working on different academic fields including accounting, political science, technology, law, and nursing in addition to those earlier listed under my education background.

I have a Bachelor’s degree in Commerce (Accounting option), and vast knowledge in various academic fields Finance, Economics, Marketing, Management, Social Science, Women and Gender, Business law, and Statistics among others.

4.80+

4+ Reviews

16+ Question Solved

Related Book For

Fundamentals of Corporate Finance

ISBN: 978-0071051606

8th Canadian Edition

Authors: Stephen A. Ross, Randolph W. Westerfield

Question Posted:

Students also viewed these Business questions

-

Youve just been introduced to the Black-Scholes option pricing model and want to give it a try, and would like to use it to calculate the value of a call option on TriHawk stock. Currently, TriHawks...

-

Consider the following data relevant to valuing a European-style call option on a nondividend paying stock: X = 40, RFR = 9 percent, T = six months (i.e., 0.5), and = 0.25. a. Compute the...

-

Assume that you have just been hired as a financial analyst by Tropical Sweets Inc., a mid-sized California company that specializes in creating exotic candies from tropical fruits such as mangoes,...

-

Linking every transport stakeholder together and ensuring seamless travel across Europe is a dream. With this objective, Amadeus, a leading global travel technology player, initiated a novel idea of...

-

Let M,N be subspaces of Rn. The perp operator acts on subspaces, we can ask how it interacts with other such operations. (a) Show that two perps cancel: (M) = M. (b) Prove that M N implies that N ...

-

In Problems 522, graph each polynomial function by following Steps 1 through 5. Steps for Graphing a Polynomial Function STEP 1: Determine the end behavior of the graph of the function. STEP 2: Find...

-

Taj Mahabub was the founder and CEO of GenAudio, a Colorado-based audio technology company. GenAudio had struggled financially practically since its formation, and Mahabub wished to secure a...

-

Sawyer Furniture is one of the few remaining domestic manufacturers of wood furniture. In the current competitive environment, cost containment is the key to its continued survival. Demand for...

-

A spherical beach pebble is completely submerged under sea water of mass density (not weight density!) 1041 kg/m3. The water exerts an upward buoyant force of magnitude 181 N on the pebble. What is...

-

Splish Splash Art is a centre that offers childrens music and dance lessons. Splish Splash prepares annual financial statements and has a December 31, 2020, year-end. a. On September 1, Splish Spash...

-

You have been hired to value a new 25-year callable, convertible bond. The bond has a 4.8 percent coupon, payable annually. The conversion price is $9, and the stock currently sells for $3.21. The...

-

Childs Manufacturing has a discount bank loan that matures in one year and requires the firm to pay $2,950. Th e current market value of the firms assets is $3,400. The annual variance for the firms...

-

Cepeda Corporation has the following cost records for June 2025. Instructions a. Prepare a cost of goods manufactured schedule for June 2025.b. Prepare an income statement through gross profit for...

-

The dispersion relation of a monatomic chain is described by the relation |sin-ka| 4C where w is the frequency, k is the wavevector, a is the spacing between the atoms, C is the spring constant of...

-

All bondholders agreed to amend the bond indenture for a financially-troubled corporation to extend the final payment date by 5 years and reduce the coupon by 1%. Does this agreement create a loss...

-

Matt Damon Inc. just issued a semiannual coupon bond, which has a coupon rate of 6.2% and matures in 24 years. The bond's price is $948 and the par value is $1,000. Assume a tax rate of 35%. The...

-

Shepard Industries had NI in the year just ended of $10 million. It spent $6 million on total capital expenditures and increases in net working capital and had $14 million in depreciation expenses....

-

provide a critical analysis for this article Sources of Information and Beliefs About the Health Effects of Marijuana Julie H. Ishida, MD, MAS, Alysandra J. Zhang, BA2, Stacey Steigerwald, MSSA, Beth...

-

In your own words, describe what affects the current yield and the yield to maturity for a bond.

-

Starr Co. had sales revenue of $540,000 in 2014. Other items recorded during the year were: Cost of goods sold ..................................................... $330,000 Salaries and wages...

-

Explain what is meant by corporate social responsibility (CSR).

-

You are assessing the viability of two projects. Project A has a 25 per cent chance of losing 1,000,000, a 50 per cent chance of breaking even and a 25 per cent chance of making 1,000,000 profit....

-

Your company has just purchased 20 fork-lift trucks and has two payment options. The first option is to pay 100,000 every month for 12 months. The second option is to pay 1,200,000 at the end of the...

-

Consider the control system in Figure where v(t) is a sinusoidal disturbance, v(t)=sin(t). Compute the absolute value of the sensitivity function at w = 1 rad/s as a function of K. How must K be...

-

ABC Corporation, a growing tech company, decides to raise capital by issuing convertible debt securities. Convertible debt allows bondholders the option to convert their debt into a predetermined...

-

Design Analog and Digital IIR Bandstop filter considering pass band edge1 20kHz, stop band edges 22 kHz & 38kHz, pass band edge2 40kHz, sampling frequency 100kHz. Additionally, draw corresponding...

Study smarter with the SolutionInn App