In the previous question, suppose all the costs are before taxes and the tax rate is 39

Question:

In the previous question, suppose all the costs are before taxes and the tax rate is 39 percent. Both types of equipment would be depreciated at a CCA rate of 25 percent (Class 9), and would have no value after the project. What are the EACs in this case? Which is the preferred method?

Data from previous question

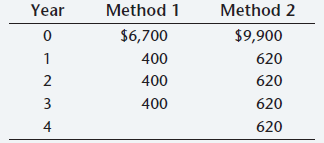

Lobo is a leading manufacturer of positronic brains, a key component in robots. The company is considering two alternative production methods. The costs and lives associated with each are:

Assuming that Lobo will not replace the equipment when it wears out, which should it buy? If Lobo is going to replace the equipment, which should it buy (r = 13%)? Ignore depreciation and taxes in answering.

Step by Step Answer:

Fundamentals of Corporate Finance

ISBN: 978-0071051606

8th Canadian Edition

Authors: Stephen A. Ross, Randolph W. Westerfield