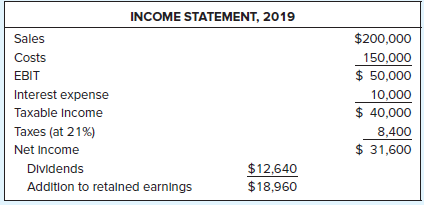

The 2019 financial statements for Growth Industries are presented below. Sales and costs are projected to grow

Question:

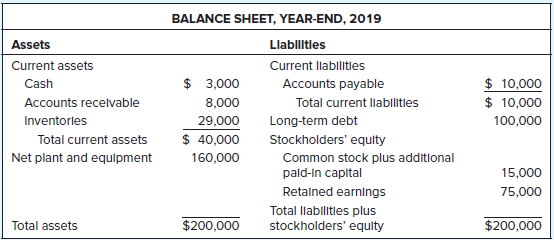

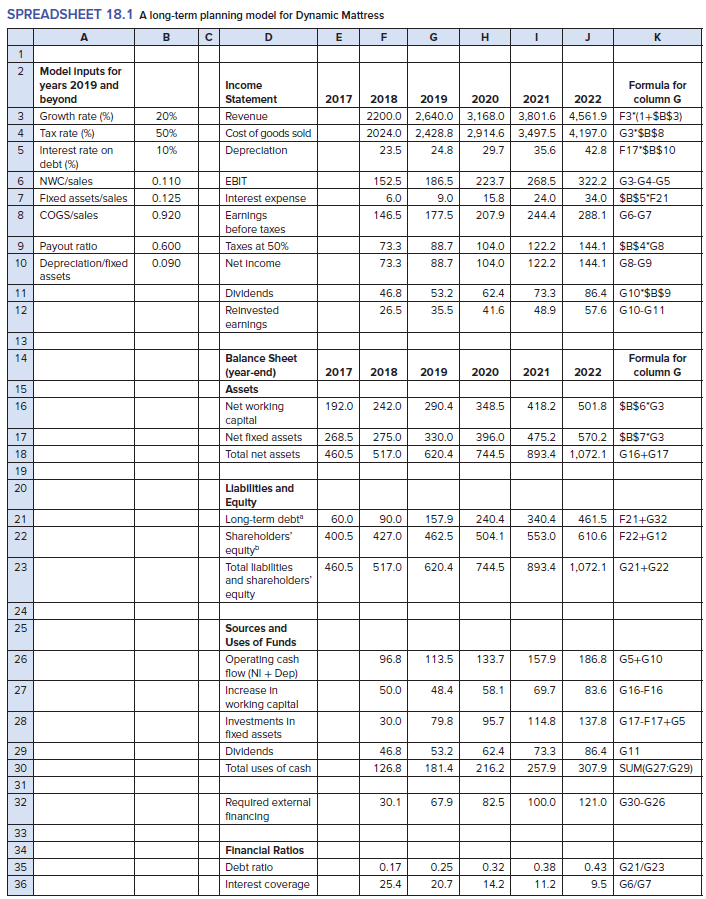

The 2019 financial statements for Growth Industries are presented below. Sales and costs are projected to grow at 20% a year for at least the next 4 years. Both current assets and accounts payable are projected to rise in proportion to sales. The firm is currently operating at full capacity, so it plans to increase fixed assets in proportion to sales. Interest expense will equal 10% of long-term debt outstanding at the start of the year. The firm will maintain a dividend payout ratio of .40. Construct a spreadsheet model for Growth Industries similar to the one in Spreadsheet 18.1.

a. How much external capital will the company require in 2023?

b. What will be the company?s debt ratio at the end of 2023?

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Fundamentals of Corporate Finance

ISBN: 978-1260566093

10th edition

Authors: Richard Brealey, Stewart Myers, Alan Marcus