You have bid for a possible export order that would provide a cash inflow of ?1 million

Question:

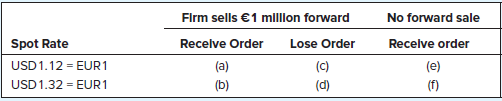

You have bid for a possible export order that would provide a cash inflow of ?1 million in 6 months. The spot exchange rate is USD1.22 = EUR1, and the 1-year forward rate is USD1.20 = EUR1. There are two sources of uncertainty: (i) The euro could appreciate or depreciate and (ii) you may or may not receive the export order. The firm may sell ?1 million forward now, or it may wait to see if it wins the order and if it does, exchange euros for dollars at the spot exchange rate at the end of the year. Fill in the following table with the firm?s dollar cash flow in each scenario. Assume that the exchange rate in 1 year will be either USD1.12 = EUR1 or USD1.32 = EUR1. Comment on the hedging efficacy of the forward sale when the firm wins the order and when it doesn?t.

The value of one currency for the purpose of conversion to another. Exchange Rate means on any day, for purposes of determining the Dollar Equivalent of any currency other than Dollars, the rate at which such currency may be exchanged into Dollars...

Step by Step Answer:

Fundamentals of Corporate Finance

ISBN: 978-1260566093

10th edition

Authors: Richard Brealey, Stewart Myers, Alan Marcus