Refer to the data in Problems 14-40 and 14-41. Al, the manager of the AC Division, complains

Question:

Refer to the data in Problems 14-40 and 14-41. Al, the manager of the AC Division, complains that the calculation of EVA is unfair, because a much longer life is assumed for the SO Division in calculating EVA. Sean, the manager of SO, responds that EVA is supposed to reflect economic reality and that the reality is that R&D investments in SO Division do have a longer life.

Required

a. Assume that the economic life of R&D investments is two years in the AC Division. What economic life would the R&D investments in the SO Division have to have to make EVA in the two divisions equal?

b. Are there other disputes that might arise about the calculation of EVA used for performance evaluation? Explain.

Data From Exercise 14-40:

R&D is assumed to have a two-year life in the AC Division and a nine-year life in the SO division. All R&D expenditures are spent at the beginning of the year. Assume there are no current liabilities and (unrealistically) that no R&D investments had taken place before this year.

Data From Exercise 14-41:

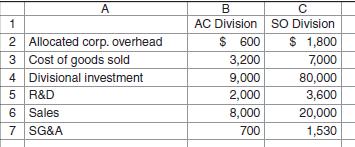

Colonial Pharmaceuticals is a small firm specializing in new products. It is organized into two divisions, which are based on the products they produce. AC Division is smaller and the life of the products it produces tend to be shorter than those produced by the larger SO Division. Selected financial data for the past year is shown below. Divisional investment is as of the beginning of the year. Colonial Pharmaceuticals uses a 9 percent cost of capital and uses beginning-of-the-year investment when computing ROI and residual income. Ignore income taxes.

Step by Step Answer:

Fundamentals of Cost Accounting

ISBN: 978-1259565403

5th edition

Authors: William Lanen, Shannon Anderson, Michael Maher