Wear Art produces precut fabrics for three products: dresses, jackets, and blouses. Joint cost is allocated on

Question:

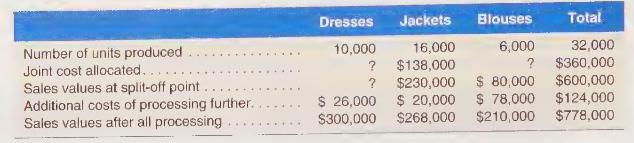

Wear Art produces precut fabrics for three products: dresses, jackets, and blouses. Joint cost is allocated on the basis of relative sales value at split-off. The company can choose to process each of the products further rather than sell the fabric at split-off. Information related to these products follows.

a. What amount of joint cost should be allocated to dresses and blouses?

b. What is the sales value at the split-off point for dresses?

c. Should any of the products be processed beyond the split-off point? Show computations.

d. If 12,000 jackets are processed further and sold at the regular selling price, what is the gross profit on the sale?

Step by Step Answer:

Cost Accounting Foundations And Evolutions

ISBN: 9781618533531

10th Edition

Authors: Amie Dragoo, Michael Kinney, Cecily Raiborn