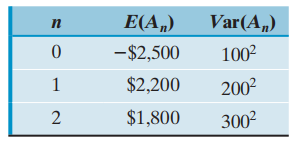

Consider an investment with the following projected cash flows: The distributions are assumed to be independent of

Question:

The distributions are assumed to be independent of each other.

(a) Compute the mean of the NPW at i = 10%. Using just the mean value, would the investment be accepted?

(b) Compute the standard deviation of the NPW distribution.

(c) Compute the two standard deviations below the mean. If these cash flows are normally distributed with the means and variances as previously specified, what is the probability that the actual NPW will fall 2σ below the mean?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: