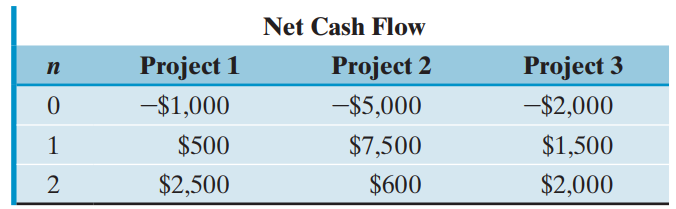

Consider the following investment projects: Assume that MARR = 15%. (a) Compute the IRR for each project.

Question:

Assume that MARR = 15%.

(a) Compute the IRR for each project.

(b) If the three projects are mutually exclusive investments, which project should be selected according to the IRR criterion?

Net Cash Flow Project 3 -$2,000 Project 2 -$5,000 Project 1 п -$1,000 $500 $7,500 $1,500 $600 $2,500 $2,000

Step by Step Answer:

a i 1 8508 i 2 5761 and i 3 4430 b Project 1 versus Project 2 This ...View the full answer

Related Video

The internal rate of return, or IRR, is a metric used to measure the profitability of an investment. It is the discount rate that makes the net present value of an investment equal to zero. To calculate the IRR, we need to know the investment\'s cash flows. These are the inflows and outflows of cash that will result from the investment. For example, an investment in a property might have cash outflows for the purchase price, closing costs, and any renovations, and cash inflows from rent and eventual sale of the property. The IRR is the discount rate at which the NPV of the investment is equal to zero. There are many ways to calculate IRR, from simple spreadsheet functions to more complex financial modeling software. It\'s worth noting that IRR can be a bit tricky when it comes to projects that don\'t have a consistent cash flow over time. These types of investments are known as \"irregular cash flow\" and the IRR might be misleading or not suitable to calculate. There are other metrics to evaluate these investments such as Modified Internal Rate of Return (MIRR) which is a variation of IRR and is used to get more accurate results.

Students also viewed these Business questions

-

Consider the following investment projects using the information in Table P5.25. (a)Compute the future worth at the end of life for each project at i = 12%. (b)Determine the acceptability of each...

-

Consider the investment projects given in Table P7.49. Assume that MARR = 15%. (a) Compute the IRR for each project. (b) On the basis of the IRR criterion, if the three projects are mutually...

-

Consider the following investment project. Suppose the company's reinvestment opportunities change over the life of the project as shown in Table P5.12 (i.e., the firm's MARR changes over the life of...

-

With the company expanding into several new markets in the coming months, Cable & Moore was anticipating a large increase in sales revenue. The future looked bright for this provider of...

-

Referring to Example 3-11, (a) What heading must the boat have if it is to land directly across the river from its starting point? (b) How much time is required for this trip if the river is 25.0 m...

-

The Amato Theater is nearing the end of the year and is preparing for a meeting with its bankers to discuss the renewal of a loan. The accounts listed below appeared in the December 31, 2020, trial...

-

A rectangular array of elliptical fibers is shown in Figure 3.5. Derive the relationship between the fiber volume fraction and the given geometrical parameters. What is the maximum possible fiber...

-

Your employer engages in numerous joint processes that produce significant quantities and types of by-product. You have been asked to give a report to management on the best way to account for...

-

Shown below are data from the Northern Company's accounting records: Year 1 Year 2 Sales Revenue $13,000,000 $14,000,000 Cost of Goods Sold 7,000,000 7,900,000 Beginning Inventory Ending Inventory...

-

A bond is issued with a coupon of 4% paid annually, a maturity of 30 years, and a yield to maturity of 7%. What rate of return will be earned by an investor who purchases the bond for $627.73 and...

-

Consider the following two investment situations: In 1980, when W.M. Company went public, 100 shares cost $1,650. That investment was worth $12,283,904 after 32 years (2012) with a rate of return of...

-

Fulton National Hospital is reviewing ways of cutting the costs for stocking medical supplies. Two new stockless systems are being considered to lower the hospitals holding and handling costs. The...

-

(a) What is crystallization? (b) Cite two properties that may be improved by crystallization.

-

If you could change three things that occurred in the development of U.S. health care, what would they be? How might things have been different as a result?

-

Consider an employee who works at the big-box store stocking shelves overnight while the store is closed. The employee begins to experience some mild to moderate low-back pain from the lifting of the...

-

direction and 0 Find magnitude, resultant for the system of forces 20 kN 25 kN location of of the 60 30 A B shown in figure. 3 m D 3 m C 45 18 kN 12 kN

-

Risk ID 1 2 3 4 5 6 7 8 9 10 Probability (%) GRK628828 40 70 75 50 30 60 90 20 30 10 Impact (ZAR) 83 010 6 484 84 434 86 383 2 246 85 865 16 075 33 430 7444 25 040 5.1 Calculate the Average Impact...

-

A 20N force acts perpendicular to the door 0.8m wide at its edge. Find moment at hinges. Also find moment at hinges if 20N force acts at 60 with the plane of door. i) 20N force acting perpendicular...

-

A new snow making machine utilizes technology that permits snow to be produced in ambient temperature of 70 degrees Fahrenheit or below. The estimated cash flows for the ski resort contemplating this...

-

Draw the appropriate control flow graph of the given pseudocode.Make sure to only use one number for blocks of code which are all sequential and when the first line is executed, all of those lines...

-

Describe the two most common methods of assessing a personality. Which is likely to be the most accurate? Why?

-

Describe the Myers-Briggs Type Indicator ( MBTI ) personality framework. Based on the framework, what would you think was your personality type? Why?

-

Identify and describe the five traits of the Big Five personality model.

-

What logic gate does this represent (reduce it) Do D

-

What basic logic gate does this implement? a b in out Not otb E in Not O out nota And out aAndNotb out Or out b notAndb a out And b

-

Design a Fuzzy system to reduce effect of impulse noise on a noisy image with intensities ranging from [0, L-1]. Let zs denotes the intensity of middle pixel of the neighborhood. The output intensity...

Study smarter with the SolutionInn App