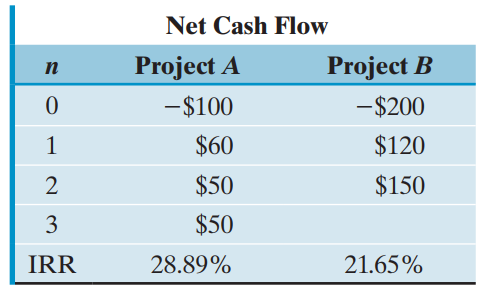

Consider the following two mutually exclusive investment projects: Assume that MARR = 15%. Which project would be

Question:

Assume that MARR = 15%. Which project would be selected under an infinite planning horizon with project repeat ability likely, according to the IRR criterion?

MARRMinimum Acceptable Rate of Return (MARR), or hurdle rate is the minimum rate of return on a project a manager or company is willing to accept before starting a project, given its risk and the opportunity cost of forgoing other...

Net Cash Flow Project B Project A п -$100 -$200 $60 $120 $150 $50 $50 3 28.89% 21.65% IRR

Step by Step Answer:

With the least common multiple of 6 project years Since the increm...View the full answer

Related Video

The internal rate of return, or IRR, is a metric used to measure the profitability of an investment. It is the discount rate that makes the net present value of an investment equal to zero. To calculate the IRR, we need to know the investment\'s cash flows. These are the inflows and outflows of cash that will result from the investment. For example, an investment in a property might have cash outflows for the purchase price, closing costs, and any renovations, and cash inflows from rent and eventual sale of the property. The IRR is the discount rate at which the NPV of the investment is equal to zero. There are many ways to calculate IRR, from simple spreadsheet functions to more complex financial modeling software. It\'s worth noting that IRR can be a bit tricky when it comes to projects that don\'t have a consistent cash flow over time. These types of investments are known as \"irregular cash flow\" and the IRR might be misleading or not suitable to calculate. There are other metrics to evaluate these investments such as Modified Internal Rate of Return (MIRR) which is a variation of IRR and is used to get more accurate results.

Students also viewed these Business questions

-

Consider the two mutually exclusive investment projects given in Table P7.56 for which MARR = 15%. On the basis of the IRR criterion, which project would be selected under an infinite planning...

-

Consider the following two mutually exclusive investment projects that have unequal service lives: (a) What assumption(s) do you need in order to compare a set of mutually exclusive investments with...

-

Consider the following two mutually exclusive investment projects: Salvage values represent the net proceeds (after tax) from the disposal of assets if they are sold at the end of the year listed....

-

What functions are normally associated with the production cycle?

-

What speed must the dragonfly have if the line of sight, which is parallel to the x axis initially, is to remain parallel to the x axis? A. 0.562 m/s B. 0.664 m/s C. 1.00 m/s D. 1.13 m/s

-

For the following pairs of sinusoids, determine which one leads and by how much. (a) v(t) = 10 cos(4t - 60o) and i(t) = 4 sin (4t + 50o) (b) v1 (t) = 4 cos(377t + 10o) and v2 (t) = -20 cos 377t (c)...

-

Suppose that it is desired to estimate the expected value of a random variable \(x\). (This random variable might be the discounted terminal value of a call option on a stock that is following a...

-

Digiread Technologies Ltd. (DTL) is a privately held distributor of e-readers and tablets. The Calgary-based company is well established and is currently managed by its founder, Erin Jacobs. The...

-

A lone wire connects two well-separated conducting spheres. One sphere has a radius of 10.0cm and an electric potential of 250.0V (using a reference of the zero point at infinite distance). The other...

-

Corsouth Mortgage Associates is a large home mortgage firm in the Southeast. It has a pool of permanent and temporary computer operators who process mortgage accounts, including posting payments and...

-

A company has to decide between two machines that do the same job but have different lives. Net Cash Flow Machine A Machine B $40,000 $55,000 $15,000 $10,000 $15,000 $10,000 $15,000 $10,000 $10,000...

-

Suppose we have four mutually exclusive projects, D1, D2, D3, and D4, whose internal rates of return on incremental investment between the projects is given as follows: IRR (D1 - D2) = 27.62% IRR (D1...

-

The graphs displayed in Figure 9.19 are population cumulative hazard functions for three distributions of the time- to- event random variable T. For each one, sketch a possible corresponding hazard...

-

Discuss the process and the uses of organizational development.

-

SmartPhone Company's ad states that its product is "The Best that Money Can Buy." This is an example of?

-

2. While researching mutual funds on the Internet, Natasha, aged 17, found a fund Wo that averaged a 14.45% annual return for the last 5 years. Assume that Natasha's money can continue to earn this...

-

Through the process of socialization we: A . learn the customs, habits, and practices of our society. B . develop our identity. C . form our individual personality. D . all of the above

-

How sustainable is leadership and creativity at Apple in keeping its competitive position?

-

Write B as a linear combination of the other matrices, if possible. -1 B = A, = A, = -3 2 A3

-

Danielle has an insurance policy with a premium of $75 per month. In September she is in an accident and receives a bill worth $2990 for the repair of her own property. Her deductible is $250 and her...

-

Compare and contrast the job attitudes discussed in this chapter.

-

How can managers increase job satisfaction and what are the organizational consequences when there are high or low levels of job satisfaction?

-

List and describe the four employee responses to dissatisfaction.

-

How can bash shell scripting improve resource utilization and process management in Unix systems?

-

A solid sphere that is uniformly positively charged produces an electric field. Assume no other objects are around. What is the magnitude of the electric field a distance r from the center of the...

-

Why is potential difference important in x - ray production?

Study smarter with the SolutionInn App