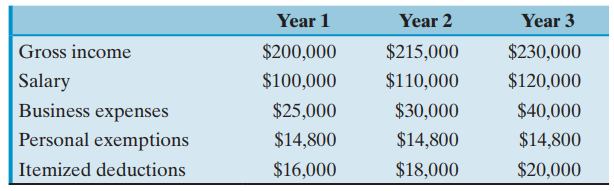

Phillip Zodrow owns and operates a small unincorporated plumbing service business, Zodrow Plumbing Service (ZPS). Phillip is

Question:

Which form of business (corporation or sole ownership) will allow Phillip to pay the lowest taxes (and retain the most income) during the three years? Personal income€tax brackets and amounts of personal exemption are updated yearly, so you need to consult the IRS tax manual for the tax rates, as well as for the exemptions, that are applicable to the tax years.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: