Lifestyle Lighting Lid. reported the following on its balance sheed at December 31. 2019: In early July

Question:

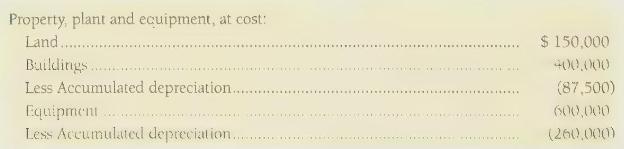

Lifestyle Lighting Lid. reported the following on its balance sheed at December 31. 2019:

In early July 2020, Lifestyle Lighting Ltd. expanded operations and purchased additional equipment at a cost of \(\$ 100,000\). The company depreciates buildings by the straight-line method over 20 years with residual value of \(\$ 50,000\). Due to obsolescence, the equipment has a useful life of only 10 years and is being depreciated by the double-diminishing-balance method with zero residual value.

{Requirements}

1. Journalize Lifestyle Lighting Ltd.'s property, plant, and equipment purchase and depreciation transactions for 2020. Why is land not depreciated?

2. Report property, plant, and equipment on the December 31, 2020, balance sheet.

Step by Step Answer:

Financial Accounting

ISBN: 9780135433065

7th Canadian Edition

Authors: Walter Harrison, Wendy Tietz, C. Thomas, Greg Berberich, Catherine Seguin