Wheelys, Inc. designs and sells footwear with a wheel in the heel, worn by sometimes annoying kids

Question:

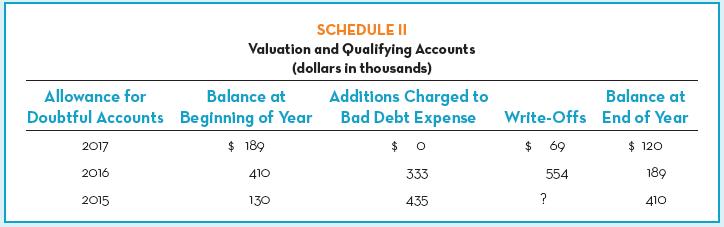

Wheelys, Inc. designs and sells footwear with a wheel in the heel, worn by sometimes annoying kids at shopping malls. It recently disclosed the following information concerning the Allowance for Doubtful Accounts in its annual report.

Required:

1. Create a T-account for the Allowance for Doubtful Accounts and enter into it the 2017 amounts from the above schedule. Then write the T-account in equation format to prove that the above items account for the changes in the account.

2. Wheelys reported sales of $70 million in 2017. Why might its Bad Debt Expense equal zero that year?

3. Record summary journal entries for 2016 related to (a) estimating Bad Debt Expense and (b) writing off specific balances.

4. Supply the missing dollar amount noted by ? for 2015.

5. If Wheelys had written off an additional $20 of Accounts Receivable during 2017 and the ending allowance balance was estimated to be $120 (dollars in thousands), how would Net Receivables have been affected? How would Net Income have been affected? Explain why.

Accounts ReceivableAccounts receivables are debts owed to your company, usually from sales on credit. Accounts receivable is business asset, the sum of the money owed to you by customers who haven’t paid.The standard procedure in business-to-business sales is that...

Step by Step Answer:

Fundamentals of Financial Accounting

ISBN: 978-1259269868

5th Canadian edition

Authors: Fred Phillips, Robert Libby, Patricia Libby, Brandy Mackintosh