Given your answers in Problems 2730, do you feel Beagle Beauties is overvalued or undervalued at its

Question:

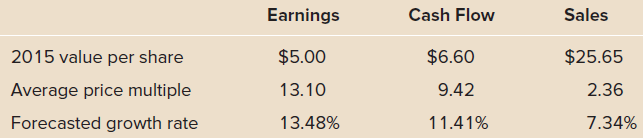

Beagle Beauties engages in the development, manufacture, and sale of a line of cosmetics designed to make your dog look glamorous. Below you will find selected information necessary to compute some Chapter 6 Common Stock Valuation 217 valuation estimates for the firm. Assume the values provided are from year-end 2015. Also assume that the firm€™s equity beta is 1.40, the risk-free rate is 2.75 percent, and the market risk premium is 7 percent.

Dividends per share .......................$ 2.04

Return on equity .............................9.50%

Book value per share ....................$17.05

Common stock is an equity component that represents the worth of stock owned by the shareholders of the company. The common stock represents the par value of the shares outstanding at a balance sheet date. Public companies can trade their stocks on...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals of Investments, Valuation and Management

ISBN: 978-1259720697

8th edition

Authors: Bradford Jordan, Thomas Miller, Steve Dolvin

Question Posted: