In Problem 12, what is the standard deviation if the correlation is +1? 0? 1? As the

Question:

Data From Problem 12

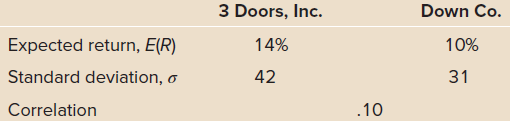

Use the following information to calculate the expected return and standard deviation of a portfolio that is 50 percent invested in 3 Doors, Inc., and 50 percent invested in Down Co.:

A portfolio is a grouping of financial assets such as stocks, bonds, commodities, currencies and cash equivalents, as well as their fund counterparts, including mutual, exchange-traded and closed funds. A portfolio can also consist of non-publicly...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals of Investments, Valuation and Management

ISBN: 978-1259720697

8th edition

Authors: Bradford Jordan, Thomas Miller, Steve Dolvin

Question Posted: