Suppose the expected market return E(R M ) equals 8%. (a) Compute CAPM betas for the stocks

Question:

Suppose the expected market return E(RM) equals 8%.

(a) Compute CAPM betas for the stocks in problem 1.

(b) Are the data in problem 1 consistent with both the CAPM and the APT?

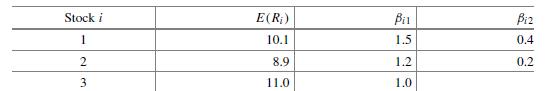

Data from problem 1

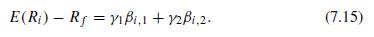

Consider the following APT model:

Suppose that the riskless rate Rf = 5%, and we have the following data for three stocks.

Transcribed Image Text:

E(R) Rf=yBi,1 + 12Bi,2. (7.15)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (QA)

Answered By

Ali Khawaja

my expertise are as follows: financial accounting : - journal entries - financial statements including balance sheet, profit & loss account, cash flow statement & statement of changes in equity -consolidated statement of financial position. -ratio analysis -depreciation methods -accounting concepts -understanding and application of all international financial reporting standards (ifrs) -international accounting standards (ias) -etc business analysis : -business strategy -strategic choices -business processes -e-business -e-marketing -project management -finance -hrm financial management : -project appraisal -capital budgeting -net present value (npv) -internal rate of return (irr) -net present value(npv) -payback period -strategic position -strategic choices -information technology -project management -finance -human resource management auditing: -internal audit -external audit -substantive procedures -analytic procedures -designing and assessment of internal controls -developing the flow charts & data flow diagrams -audit reports -engagement letter -materiality economics: -micro -macro -game theory -econometric -mathematical application in economics -empirical macroeconomics -international trade -international political economy -monetary theory and policy -public economics ,business law, and all regarding commerce

4.00+

1+ Reviews

10+ Question Solved

Related Book For

Investment Valuation And Asset Pricing Models And Methods

ISBN: 9783031167836

1st Edition

Authors: James W. Kolari, Seppo Pynnönen

Question Posted:

Students also viewed these Business questions

-

While you are running down the street you give off 4.7x10 4 joules of heat and you do 6.8x10 4 J of work. What is your change in internal energy?

-

Q1. You have identified a market opportunity for home media players that would cater for older members of the population. Many older people have difficulty in understanding the operating principles...

-

CANMNMM January of this year. (a) Each item will be held in a record. Describe all the data structures that must refer to these records to implement the required functionality. Describe all the...

-

Different theories about early childhood inform approaches to children's learning and development. Early childhood educators draw upon a range of perspectives in their work ..." (EYLF p.12)....

-

What is the value of getting employees to compete against a goal instead of against one another?

-

Propagas is used in some central heating systems where natural gas is not available. It burns according to the following equation: a. What are the chemical names for propagas and natural gas? b....

-

The pressure drop, \(\Delta p\), over a certain length of horizontal pipe is assumed to be a function of the velocity, \(V\), of the fluid in the pipe, the pipe diameter, \(D\), and the fluid density...

-

Fausto Fabricators Inc. uses a standard cost system to account for its single product. The standards established for the product include the following: Materials . . . . . . . . . . . . . . . . . . ....

-

Income Statement For the Year Ended December 31, 2025 Net sales $446,200 Cost of goods sold 211,400 Gross profit 234,800 Expenses (including $16,400 interest and $28,500 income taxes) 76,100 Net...

-

Refer to the Campbell Soup annual report in Appendix A. Required: a. What type of pension plan does Campbell Soup offer its employees? b. Does Campbell Soup have a net pension asset or a net pension...

-

Form the equal-weighted portfolio of the stocks in problem 1. (a) Compute i , 1 and i , 2 for the portfolio. (b) Compute the expected return of the portfolio. (c) Compute the portfolios risk...

-

The intensity levels I of two earthquakes measured on a seismograph can be compared by the formula where M is the magnitude given by the Richter Scale. In August 2009, an earthquake of magnitude 6.1...

-

Discuss sources of lower input costs and how they provide the basis of a cost advantage strategy.

-

From the following trial balance of B. Morse drawn-up on conclusion of his first year in business, draw up an income statement for the year ending 31 December 2013. A statement of financial position...

-

Choose a firm that has already expanded internationally. For one or more of the firms markets, measure all four types of distance between the firms home country and the country entered. Evaluate the...

-

Why is it likely to have preexisting normal faults in an orogenic belt?

-

What are conjugate faults, and what stress information do they give?

-

The following summaries for Maryland Service, Inc., and Grapone, Co., provide the information needed to prepare the stockholders equity section of each companys balance sheet. The two companies are...

-

TRUE OR FALSE: 1. Banks with a significantly large share of fixed-interest rate home loans are less exposed to interest rate risks. 2. Although Australian banks are pretty big, they are not...

-

Ms. Yamisaka has determined that the average monthly return of another Mega client was 1.63 percent during the past year. What is the annualized rate of return? a. 5.13 percent b. 19.56 percent c....

-

The return calculation method most appropriate for evaluating the performance of a portfolio manager is a. Holding period b. Geometric c. Money-weighted (or dollar-weighted)

-

The rates of return on Cherry Jalopies, Inc., stock over the last five years were 17 percent, 11 percent, 2 percent, 3 percent, and 14 percent. Over the same period, the returns on Straw Construction...

-

Problem 1: A baseball of mass m = 0.155 kg is suspended vertically from a tree by a string of length L = 1.1 m and negligible mass. Take z as the upward vertical direction. A short-duration force F =...

-

How much work (in J) is done by the boy pulling his sister 21 m in a wagon as shown below? Assume no friction acts on the wagon. ] F = 60 N 34 d = 21 m

-

How much gravitational potential energy (in J) (relative to the ground on which it is built) is stored in an Egyptian pyramid, given its mass is about510 9 kg and its center of mass is 23.0m above...

Study smarter with the SolutionInn App