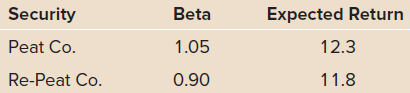

Suppose you observe the following situation: Assume these securities are correctly priced. Based on the CAPM, what

Question:

Assume these securities are correctly priced. Based on the CAPM, what is the expected return on the market? What is the risk-free rate?

Transcribed Image Text:

Beta Expected Return Security Peat Co. 1.05 12.3 Re-Peat Co. 11.8 0.90

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 57% (7 reviews)

Here we have the expected return and beta for two assets We ...View the full answer

Answered By

Akash Goel

I am in the teaching field since 2008 when i was enrolled myself in chartered accountants course

Since then i have an experience of teaching of class XI, XII, BCOM, MCOM, MBA, CA CPT.

5.00+

1+ Reviews

10+ Question Solved

Related Book For

Fundamentals of Investments, Valuation and Management

ISBN: 978-1259720697

8th edition

Authors: Bradford Jordan, Thomas Miller, Steve Dolvin

Question Posted:

Students also viewed these Business questions

-

Suppose you observe the following 1-year interest rates, spot exchange rates and futures prices. Futures contracts are available on 10,000. How much risk-free arbitrage profit could you make on 1...

-

Suppose you observe the following month-end stock prices for stocks A and B: For each stock: a. Compute the mean monthly continuously compounded return. What is the annual return? b. Compute the mean...

-

Suppose you observe the following month-end stock prices for stocks A and B: For each stock: a. Compute the mean monthly continuously compounded return. What is the annual return? b. Compute the mean...

-

Four years from now you hope to buy your dream car. Today, that car costs $54,500. You expect the price to increase by an average of 3.1 percent per year over the next four years. How much will your...

-

What does the atomic number of an element tell you about the element?

-

Penny calculates that the deviations from the mean for a data set of eight values are 0, - 40, -78, -71, 33, 36, 42, and 91. a. How do you know that at least one of the deviations is incorrect? b. If...

-

How can HRIS T&D applications help firms foster organizational learning?

-

A solid conducting sphere with radius R carries a positive total charge Q. The sphere is surrounded by an insulating shell with inner radius R and outer radius 2R. The insulating shell has a uniform...

-

1. Construct a truth table for the following: a. out x'yz +(xyz)' b. out (x+z')(x+y')(y+z) 2. Simplify the following functional expressions using Boolean algebra and its identities. List the identity...

-

The City of Castletons General Fund had the following post-closing trial balance at June 30, 2019, the end of its fiscal year: During the year ended June 30, 2020, the following transactions, in...

-

Fill in the following table, supplying all the missing information. Use this information to calculate the securitys beta. Returns Return Deviations Product of Deviations Squared Deviations Security...

-

In Problem 12, what would the risk-free rate have to be for the two stocks to be correctly priced relative to each other? Data From Problem 12 Stock Y has a beta of 1.05 and an expected return of 13...

-

In the hybrid orbital model, compare and contrast bonds with bonds. What orbitals form the bonds and what orbitals form the bonds? Assume the z-axis is the internuclear axis.

-

a) Calculate Financial Ratios (any 12 ratios) of year 2014 and 2013 on the basis of the Balance sheet and Income Statement? b) Using Common size and Index analysis, Evaluate the company's financial...

-

Briefly explain what you found interesting or challenging from the passage? What do we forget when we talk through machines? We are tempted to forget the importance of face-to-face conversation,...

-

According to you, how did the interview go? What do you think might be the outcome of the interview and why? Please explain with examples and suggest next steps in the selection process that would...

-

What symmetry elements does this compound have: Tetrabromopalladinate (PdBr) (planar) As this compound is planar, what is the molecular geometry around the palladium atom? Therefore, what is the...

-

Suppose that you have collected the following data from a process to establish-chart (x-bar-chart) and an R-chart, where each sample has three observations. Sample Number 1 2 1 11 11.2 Observations 2...

-

1. What entry strategy has Starbucks used internationally? Should Tata Starbucks use a strategy that is modified for the Indian market or should it pursue the same strategy it has in all other...

-

Borrowing costs should be recognised as an expense and charged to the profit and loss account of the period in which they are incurred : A. If the borrowing costs relate to qualifying asset B. If the...

-

Over a three-year period, the average annual return on a portfolio was 20 percent and the beta for the portfolio was 1.25. During the same period, the average annual return on 90-day Treasury bills...

-

Which portfolio has the highest Treynor ratio? a. P b. Q c. R d. S. A pension fund administrator wants to evaluate the performance of four portfolio managers. Each manager invests only in U.S. common...

-

Over a three-year period, the average return on a portfolio was 20 percent and the beta for the portfolio was 1.25. During the same period, the average return on 90-day Treasury bills was 5 percent....

-

Show that for the linear regression model Y = XTB + , the leave-one-out cross validation identity: where H = n (Yi - (-i)) n Yi - i=1 i 2 Hii 2 " X(XX)-XT is the hat matrix and H; is the ith diagonal...

-

DQ: Chapter 3 talks about GDP. If California was a separate country, it would rank as the 5th largest economy after the US, Japan, China, and Germany. Explain what GDP is and how is it different than...

-

then A-1 = Given b= A -13-11 -5 14 -47 1 -3 10 solve Axb using A-.

Study smarter with the SolutionInn App