Which portfolio has the highest Treynor ratio? a. P b. Q c. R d. S. A pension

Question:

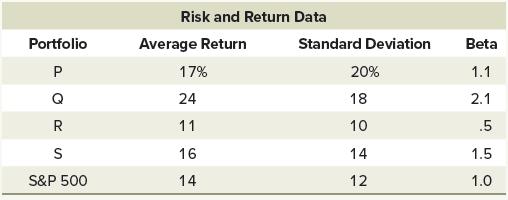

Which portfolio has the highest Treynor ratio?

a. P

b. Q

c. R

d. S.

A pension fund administrator wants to evaluate the performance of four portfolio managers. Each manager invests only in U.S. common stocks. During the most recent five-year period, the average annual total return on the S&P 500 was 14 percent and the average annual rate on Treasury bills was 8 percent. The table above shows risk and return measures for each portfolio.

Transcribed Image Text:

Portfolio P R S S&P 500 Risk and Return Data Average Return 17% 24 11 16 14 Standard Deviation 20% 18 10 14 12 Beta 1.1 2.1 .5 1.5 1.0

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (QA)

The Treynor ratio is a riskadjusted performance measure that relates the return in excess ...View the full answer

Answered By

Lamya S

Highly creative, resourceful and dedicated High School Teacher with a good fluency in English (IELTS- 7.5 band scorer) and an excellent record of successful classroom presentations.

I have more than 2 years experience in tutoring students especially by using my note making strategies.

Especially adept at teaching methods of business functions and management through a positive, and flexible teaching style with the willingness to work beyond the call of duty.

Committed to ongoing professional development and spreading the knowledge within myself to the blooming ones to make them fly with a colorful wing of future.

I do always believe that more than being a teacher who teaches students subjects,...i rather want to be a teacher who wants to teach students how to love learning..

Subjects i handle :

Business studies

Management studies

Operations Management

Organisational Behaviour

Change Management

Research Methodology

Strategy Management

Economics

Human Resource Management

Performance Management

Training

International Business

Business Ethics

Business Communication

Things you can expect from me :

- A clear cut answer

- A detailed conceptual way of explanation

- Simplified answer form of complex topics

- Diagrams and examples filled answers

4.90+

46+ Reviews

54+ Question Solved

Related Book For

Fundamentals Of Investments Valuation And Management

ISBN: 9781266824012

10th Edition

Authors: Bradford Jordan, Thomas Miller, Steve Dolvin

Question Posted:

Students also viewed these Business questions

-

The Treynor portfolio performance measure for Portfolio P is: a. 8.18. b. 7.62. c. 6.00. d. 5.33. A pension fund administrator wants to evaluate the performance of four portfolio managers. Each...

-

The Jensens alpha portfolio performance measure for Portfolio R is: a. 2.4 percent. b. 3.4 percent. c. 0 percent. d. 1 percent. A pension fund administrator wants to evaluate the performance of four...

-

Which portfolio has the highest Jensens alpha? a. P b. Q c. R d. S. A pension fund administrator wants to evaluate the performance of four portfolio managers. Each manager invests only in U.S. common...

-

Suppose a single 802.11n client is connected to an 802.11n access point and there is no other client or access point in the neighborhood. The client senses the medium, then sends a 2000-Byte frame,...

-

The activation energy for the diffusion of carbon in chromium is 111,000 J/mol. Calculate the diffusion coefficient at 1100 K (827C), given that D at 1400 K (1127C) is 6.25 10 -11 m 2 /s.

-

DJS Investment Services must develop an investment portfolio for a new client. As an initial investment strategy, the new client would like to restrict the portfolio to a mix of two stocks: The...

-

Adjusting entries are often required in accounting. Please describe the various types of adjusting entries and give at least three examples.

-

All airplane passengers at the Lake City Regional Airport must pass through a security screening area before proceeding to the boarding area. The airport has three screening stations available, and...

-

3. Consider the following setup: a) Which link is the bottleneck link? b) What is the end-to-end throughput (in Mbit/s) of the below configuration? Server R$ 12 Mbit/s Rc 5 Mbit/s Client 4. Back to...

-

Over a three-year period, the average annual return on a portfolio was 20 percent and the beta for the portfolio was 1.25. During the same period, the average annual return on 90-day Treasury bills...

-

Over a three-year period, the average return on a portfolio was 20 percent and the beta for the portfolio was 1.25. During the same period, the average return on 90-day Treasury bills was 5 percent....

-

From the following, calculate the net cash flows from operating activities (use the direct method): Sales ................ 9,500 Cost of Goods Sold .......... 4,000 Salaries Expense ........... 1,220...

-

Three identical conducting spheres, A, B, and C, are given different initial charges. Sphere A, which initially carries 12 units of negative charge, is brought in contact with sphere \(B\), which...

-

You pour \(5.0 \mathrm{~L}\) of water at \(20^{\circ} \mathrm{C}\) into a large pot to make spaghetti. If the heating element on your stove is rated at \(1250 \mathrm{~W}\), how many minutes does it...

-

Develop a StdRandom client (with appropriate static methods of its own) to study the following problem: Suppose that in a population of 100 million voters, \(51 \%\) vote for candidate \(A\) and \(49...

-

Suppose that \(x_{i}\) is endogenous in the regression \(y_{i}=\beta_{1}+\beta_{2} x_{i}+e_{i}\). Suppose that \(z_{i}\) is an instrumental variable that takes two values, one and zero. a. Let...

-

The governing equation for an RLC circuit driven by the applied voltage \(v_{a}(t)\) is derived as \[L \frac{d i}{d t}+R i+\frac{1}{C} \int i d t=v_{a}(t)\] where \(L=4 \mathrm{H}, R=4 \Omega\), and...

-

Travelcraft Company manufactures a complete line of fiberglass suitcases and attache cases. The firm has three manufacturing departments: Molding, Component, and Assembly. There are also two service...

-

What impact has the Internet had on the globalization of small firms? How do you think small companies will use the Internet for business in the future?

-

Read the article, Exploring Religious Congregations? Registration With the IRS by Christopher Scheitle, Erica Dollhop-f, and John McCarthy. (See Articles.) Discuss the role New Institution Theory may...

-

Should higher education be considered a private good, to be paid for by those who benefit from it? Or should it be considered a public good, available as a right to all citizens (like K-12 education)?

-

Should health care be considered a public, private, or common good?

-

Chad Williams, CEO of Red Cloud Mining, a Toronto based consultancy to the mining sector has a challenge to overcome. A client is seeking his company's assistance to place a value on a non-producing...

-

At December 31, 2025, Sarasota Company has outstanding noncancelable purchase commitments for 39,500 gallons, at $3.42 per gallon, of raw material to be used in its manufacturing process. The company...

-

A formal organization certified by the National Labor Relations Board and authorized to act on behalf of employees regarding wages, benefits, working conditions, conditions of employment and job...

Study smarter with the SolutionInn App