The beta of stock B is closest to: a. 0.51 b. 1.07 c. 1.46 Janet Bellows, a

Question:

a. 0.51

b. 1.07

c. 1.46

Janet Bellows, a portfolio manager, is attempting to explain asset valuation to a junior colleague, Bill Clay. Ms. Bellows€™s explanation focuses on the capital asset pricing model (CAPM). Of particular interest is her discussion of the security market line (SML) and its use in security selection. After a short review of the CAPM and SML, Ms. Bellows decides to test Mr. Clay€™s knowledge of valuation using the CAPM. Ms. Bellows provides the following information for Mr. Clay:

- The risk-free rate is 7 percent.

- The market risk premium during the previous year was 5.5 percent.

- The standard deviation of market returns is 35 percent.

- This year, the market risk premium is estimated to be 7 percent.

- Stock A has a beta of 1.30 and is expected to generate a 15.5 percent return.

- The correlation of stock B with the market is .88.

- The standard deviation of stock B€™s returns is 58 percent.

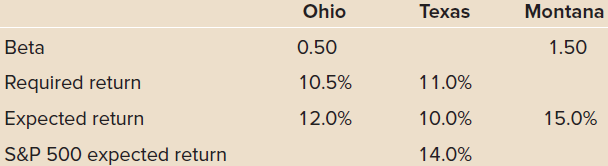

Then Ms. Bellows provides Mr. Clay with the following information about Ohio Manufacturing, Texas Energy, and Montana Mining:

The Capital Asset Pricing Model (CAPM) describes the relationship between systematic risk and expected return for assets, particularly stocks. The CAPM is a model for pricing an individual security or portfolio. For individual securities, we make use of the security market line (SML) and its... Portfolio

A portfolio is a grouping of financial assets such as stocks, bonds, commodities, currencies and cash equivalents, as well as their fund counterparts, including mutual, exchange-traded and closed funds. A portfolio can also consist of non-publicly...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals of Investments, Valuation and Management

ISBN: 978-1259720697

8th edition

Authors: Bradford Jordan, Thomas Miller, Steve Dolvin

Question Posted: