You find that the one-, two-, three-, and four-year interest rates are 4.2 percent, 4.5 percent, 4.9

Question:

Data From Problem 31

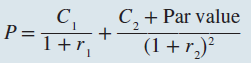

One method used to obtain an estimate of the term structure of interest rates is called bootstrapping. Suppose you have a one-year zero coupon bond with a rate of r1 and a two-year bond with an annual coupon payment of C. To bootstrap the two-year rate, you can set up the following equation for the price (P) of the coupon bond:

Because you can observe all of the variables except r2, the spot rate for two years, you can solve for this interest rate. Suppose there is a zero coupon bond with one year to maturity that sells for $949 and a two-year bond with a 7.5 percent coupon paid annually that sells for $1,020. What is the interest rate for two years? Suppose a bond with three years until maturity and an 8.5 percent annual coupon sells for $1,029. What is the interest rate for three years?

CouponA coupon or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity. Coupons are usually referred to in terms of the coupon rate (the sum of coupons paid in a... Maturity

Maturity is the date on which the life of a transaction or financial instrument ends, after which it must either be renewed, or it will cease to exist. The term is commonly used for deposits, foreign exchange spot, and forward transactions, interest...

Step by Step Answer:

Fundamentals of Investments, Valuation and Management

ISBN: 978-1259720697

8th edition

Authors: Bradford Jordan, Thomas Miller, Steve Dolvin