PMC acquired 100% of S Company for 200,000 when the fair value of the identifiable net assets

Question:

PMC acquired 100% of S Company for 200,000 when the fair value of the identifiable net assets was 160,000. PMC operates in three geographical regions: Europe, North America, and South America. Each region is classified as a CGU (each unit generates cash independently of the other regions). All three regions are expected to benefit from the acquisition of S Company and goodwill is allocated 50%:25%:25% to Europe, North America, and South America, respectively. The net identifiable assets of S Company were assigned to the Europe CGU. Goodwill is tested for impairment on December 31 of each year. The only goodwill on the books is from the acquisition of S Company. Assume the cost of disposal for each CGU is negligible (for this example).

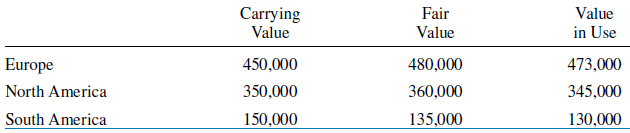

On December 31, carrying value, the fair value, and the value in use (as projected by PMC) for each CGU were as follows (the carrying value does not include goodwill):

Required:

A. If PMC uses the fair value method to record noncontrolling interest, determine the amount of goodwill impairment (and any asset impairment, if needed).

B. If PMC uses the proportionate method to record noncontrolling interest, determine the amount of goodwill impairment (and any asset impairment, if needed).

C. How is goodwill impairment tested using U.S. GAAP?

GoodwillGoodwill is an important concept and terminology in accounting which means good reputation. The word goodwill is used at various places in accounting but it is recognized only at the time of a business combination. There are generally two types of...

Step by Step Answer: