Given the following zero-coupon yields, compare the yield to maturity for a three-year zero-coupon bond, a three-year

Question:

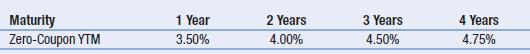

Given the following zero-coupon yields, compare the yield to maturity for a three-year zero-coupon bond, a three-year coupon bond with 4% annual coupons, and a three-year coupon bond with 10% annual coupons.

All of these bonds are default free.

Transcribed Image Text:

Maturity Zero-Coupon YTM 1 Year 3.50% 2 Years 4.00% 3 Years 4.50% 4 Years 4.75%

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (QA)

PLAN From the information provided the yield to maturity of the threeyear zerocoupon bond is ...View the full answer

Answered By

Parvesh Kumar

I am an experienced Mathematics and Statistics tutor with 10 years of experience teaching students and working professionals. I love teaching students who are passionate to learn subjects or wants to understand any mathematics and statistics concept at graduation or master’s level. I have worked with thousands of students in my teaching career. I have helped students deal with difficult topics and subjects like Calculus, Algebra, Discrete Mathematics, Complex analysis, Graph theory, Hypothesis testing, Probability, Statistical Inference and more. After learning from me, students have found Mathematics and Statistics not dull but a fun subject. I can handle almost all curriculum of mathematics. I did B.Sc (mathematics), M.Sc (mathematics), M.Tech (IT) and am also Gate (CS) qualified. I have worked in various college and school and also provided online tutoring to American and Canadian students. I look forward to discussing with you and make learning a meaningful and purposeful

5.00+

4+ Reviews

10+ Question Solved

Related Book For

Fundamentals Of Corporate Finance

ISBN: 9781292437156

5th Global Edition

Authors: Jonathan Berk, Peter DeMarzo, Jarrad Harford

Question Posted:

Students also viewed these Business questions

-

Managing Scope Changes Case Study Scope changes on a project can occur regardless of how well the project is planned or executed. Scope changes can be the result of something that was omitted during...

-

The investments of Harry and Belinda have done well through the years. While the cash portion of their portfolio has risen to $16,000, it is earning a minuscule 1 percent in a money market account;...

-

1. You are interested in purchasing a newly issued $1,000 par, 20-year, 4.80% semiannual coupon bond. Calculate the duration for the bond. Report the duration to two decimal places. 2. On June 1,...

-

During FY 2017, the voters of Surprise County approved construction of a $21 million police facility and an $11 million fire station to accommodate the county's population growth. The construction...

-

Zappos, the world's largest online shoe retailer, discusses its commitment to social responsibility and to ethical behavior. Developing employee activities and long-term relationships with charitable...

-

What are the dangers of using only business unit measures to evaluate the performance of business unit managers?

-

In 2004, Jui-Chen Lin, a citizen of China, entered into an agreement with Robert Chiu and Charles Cobb, citizens of the United States, to form an LLC to acquire and operate a fast-food restaurant in...

-

Best Trim, a manufacturer of lawn mowers, predicts that it will purchase 204,000 spark plugs next year. Best Trim estimates that 17,000 spark plugs will be required each month. A supplier quotes a...

-

Discuss the business benefits of adopting the relational database model within an organization. How does a relational model create or enhance business value? Are there any limitations to using a...

-

What depreciation deduction would be allowed for HomeNets $7.5 million lab equipment using the MACRS method, assuming the lab equipment is designated to have a five-year recovery period? For clarity,...

-

Given the yield curve shown in Figure 6.2, what is the price of a five-year risk-free zero-coupon bond with a face value of $100?

-

You drive a car on a winter day with the atmospheric air at 15C and you keep the outside front windshield surface temperature at + 2C by blowing hot air on the inside surface. If the...

-

What are policy controls plans? How do policies differ from laws?

-

Describe the key control plans associated with OE/S processes.

-

Describe the relationship between the control matrix and the systems flowchart.

-

a. Explain how bar code readers work. b. Explain how optical character recognition (OCR) works and how it differs from bar code technology. c. Explain how scanners are used to capture data.

-

What is the purpose of the strategic IT plan?

-

A 1-g sample of a certain fuel is burned in a bomb calorimeter that contains 2 kg of water in the presence of 100 g of air in the reaction chamber. If the water temperature rises by 2.5C when...

-

If a test has high reliability. O the test measures what the authors of the test claim it measures O people who take the same test twice get approximately the same scores both times O scores on the...

-

Corporate managers work for the owners of the corporation. Consequently, they should make decisions that are in the interests of the owners, rather than in their own interests. What strategies are...

-

Think back to the last time you ate at an expensive restaurant where you paid the bill. Now think about the last time you ate at a similar restaurant, but your parents paid the bill. Did you order...

-

Suppose you are considering renting an apartment. You, the renter, can be viewed as an agent while the company that owns the apartment can be viewed as the principal. What agency conflicts do you...

-

To what potential should you charge a 1.0 uF capacitor to store 4.0 J of energy? Express your answer in volts. 0 ? V = V

-

A steel cable on a bridge is 6 6 0 m long and 4 cm in diameter. A wave pulse is sent along the cable. You observe it takes the pulse 1 7 s to return. What is the wave speed in the cable? What is the...

-

9. A silicon pn junction in thermal equilibrium at T = 300 K is doped such that EF - Eri = 0.365 eV in the n region and Eri - EF 0.330 eV in the p region. (a) Sketch the energy-band diagram for the...

Study smarter with the SolutionInn App