PLAN From Eq. 21.2, and the fact that the strike price is $20, we see that the

Question:

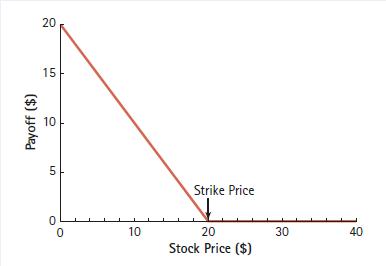

PLAN From Eq. 21.2, and the fact that the strike price is $20, we see that the value of the put option is:

![]()

EXECUTE Plotting this function gives:

EVALUATE Because the put option allows you to force the put writer to buy the stock for $20, regardless of the current market price, we can see that the put option payoff increases as Oracle’s stock price decreases. For example, if Oracle’s price were $10, you could buy a share of Oracle in the market for $10 and then sell it to the put writer for $20, making a profit of $10.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals Of Corporate Finance

ISBN: 9781292437156

5th Global Edition

Authors: Jonathan Berk, Peter DeMarzo, Jarrad Harford

Question Posted: